Appearance on the Circuit podcast: Japan's semiconductor industry

Renesas, Rapidus and more; plus post-podcast update

Friends,

This week has seen a deluge of “last post of the year” posts on Substack. Which served as a reminder to finish up fall semester grading (a higher priority than newsletters, it’s true) and try to get a couple more out before the year closes. So here goes!

A warm welcome to new readers. By way of introduction, in this newsletter I generally cover themes related to my instruction:

Strategy for the Networked Economy

Clusters: Locations, Ecosystems and Opportunity

Business in Japan

Competitive Strategy

With the occasional seasonal foray off-topic thrown in. Thanks for being here!

Special thanks to

and for the kind recommendations - I suspect that’s how some new readers got here.In my last post, I talked about how METI Minister Nishimura Yasutoshi, in open forum at the Haas School of Business, laid out a very thoughtful argument in support of the Rapidus project in Chitose, Hokkaido. To recap: the Rapidus JV is a coalition project with the goal of getting Japan back up close to the technology frontier in semiconductor fabrication.

That interaction was sparked by a question from semiconductor analyst

, who co-hosts The Circuit podcast along with analyst Ben Bajarin. So, naturally, Jay and I decided to continue our conversation! I joined Episode 45 to continue discussion of the topic of Japan and semiconductors (Transistor | Apple | Spotify | Google ) .It was great fun. Thanks again to

for having me on.(There was a little echo on the line, from my end. Some of that is from years of “active listening” on calls with Japan. )

Outside of the Rapidus venture, we succinctly covered a few decades of history (such as: why didn’t TSMC come out of Japan?), and introduced a few companies today that merit watching, such as Renesas (TSE: 6723) in automotive; and Sony (TSE: 6758) in CMOS sensors; and Murata (TSE: 6981), acquirer of Jay’s old employer Peregrine.

We also got into the precedent set by Japan (the JIC fund, an successor fund to INCJ, referred to later) preemptively buying out JSR (TSE: 4185), a maker of photoresists. Japan has a variety of mid-sized firms (AGC, Nitto Denko, Mitsui Chemical are some we referred to) that excel in their fields but are not too big to be bought - thus, I wouldn’t be surprised if the JSR acquisition was followed by others.

For those interested in exploring historical forks in the road, I recommend Michael Malone’s The Intel Trinity, which revisits how Intel founding CEO Robert Noyce became Silicon Valley’s evangelist in Washington DC to help protect the Silicon Valley semiconductor against what was then an onslaught from Japan’s semiconductor industry. (This preceded the 1986 semiconductor trade agreement I alluded to in the interview.) I also suggest the

installment on the Intel-NEC lawsuit regarding the V20’s microcode. It’s a fantastic read.A word about Renesas (btw, in Japanese, it’s written as ルネサス, or Ru-ne-sas): Renesas was created in 2002 out of the non-DRAM assets of NEC and Hitachi. DRAM (except that from Toshiba, which will eventually get its own Circuit episode, right, Jay?) was poured into Elpida Memory, now part of Micron. Some of this will be familiar to readers of Chris Miller’s excellent Chip War, from 2022.

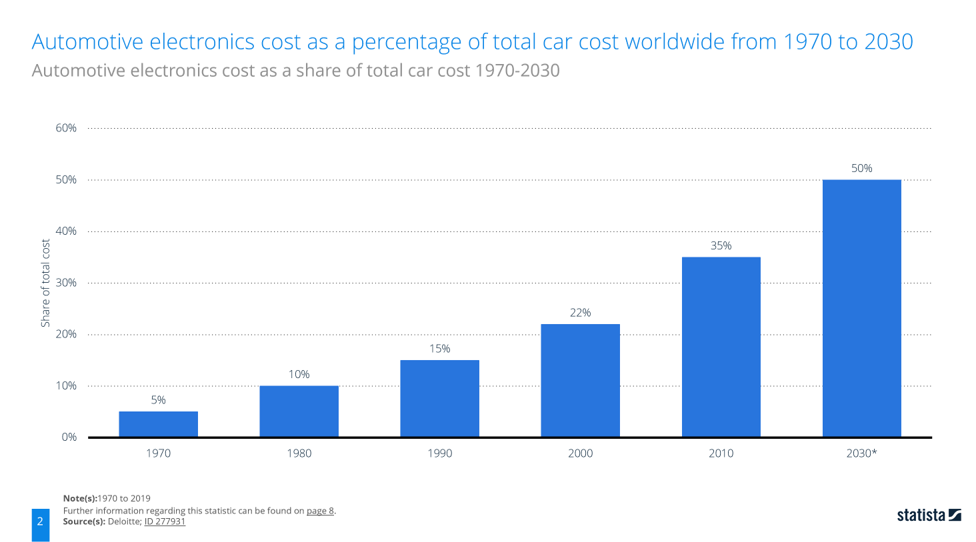

During the conversation with Jay, I recalled an episode visiting Renesas HQ. That visit was in the early 2010s. At the time, Renesas had two business units: #1 Business Unit: Automotive; and #2: Everything Else. That visit came as consumer IoT was starting to take off (and this was the focus of the conversation my host and I had). Automotive meant microcontrollers, which were benefitting from the increased value-add of chip and software content as cars get smarter.

At the time Renesas was propped up by INCJ, a sovereign fund which was generally used to prop up struggling national champions (a topic on which

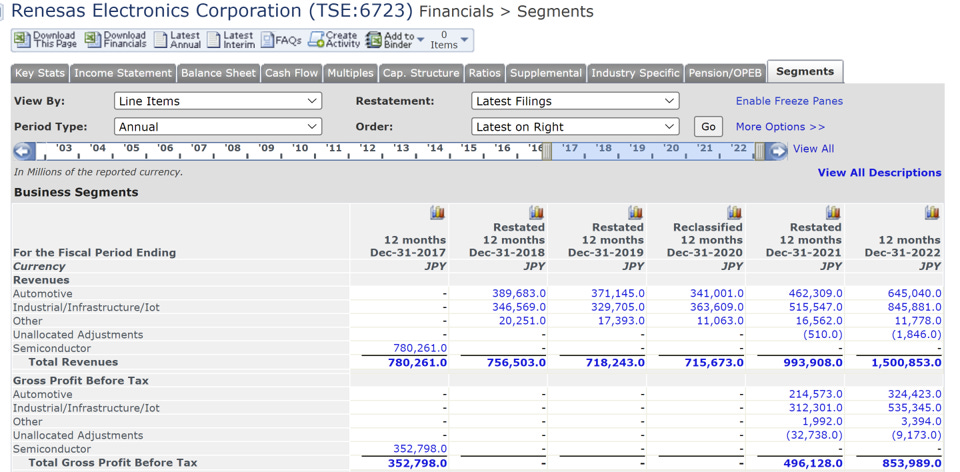

comments in his new book). As of November 2023, INCJ finally unwound its shareholdings. As of today, Strategy Analytics (on behalf of for Infineon) estimates Renesas has 8.5% overall share in automotive semis (with similar share estimates for TI and NXP), though I suspect that’s an all-in number, as I’m used to seeing automotive MCU share estimates ranging between 20-30%. And remember how the 3/11 earthquake in Japan, which impacted Renesas, rippled into automotive supply chains around the world.The automotive story for Renesas is a known one, as is the tension between Sony as embedded sensor company versus Sony as consumer product company (a tension Samsung also shares). What prompted our conversation on The Circuit was more active M&A by Japanese chip companies, and indeed in recent years Renesas has acquired Dialog Semiconductor, Sequans, and Panthronics AG, among other acquisitions. Broadly, they extend Renesas’ reach into different IoT end markets, and automotive and industrial markets in particular, and imply connectivity over a variety of short-range and longer-range air interfaces. As everything connects, there are a growing number of places for products that help move bits around.

Btw, Renesas still is organized into two business units, Automotive, and Industrial/Infrastructure/IoT. Here’s a look at segment revenue from Capital IQ. The impact of growth by acquisition is visible.

Back to the Rapidus venture. In speaking with Jay, I shared a high-level perspective on Japan about the benefits of administrative continuity, inexpensive land, and a relatively business-friendly environment. Semiconductor fabrication has two near monopoly providers - TSMC (for leading edge nodes), and ASML (for EUV). Thus, some diversification in where fabrication happens may be healthy for the industry long-term, though I will note ASML has set up a Chitose office.

It was interesting to see

take a deeper look at some of these attributes in a very bullish post. I’m glad he picked up on construction as one of them.Short answer, I agree, though I would give the same caveats I gave to Jay - Japan is aging, shrinking and centralizing. It has about 3% foreign national share of population (up from 1% when I lived there). This as compared to the San Francisco Bay Area, which has about 38% first-generation households. Can Japan keep international students who come to its universities? Certainly, the international students are a majority in my classes when I guest-teach at Waseda Business School, but I suspect there’s some sample bias there. Can Japan, to paraphrase the famous John Doerr quote, staple a residency permit to every STEM and business grad of its many wonderful universities? Can it expand its nascent Startup Founder Visa and Digital Worker programs? It is probably easier to get a visa to Japan now than it has ever been in my lifetime.

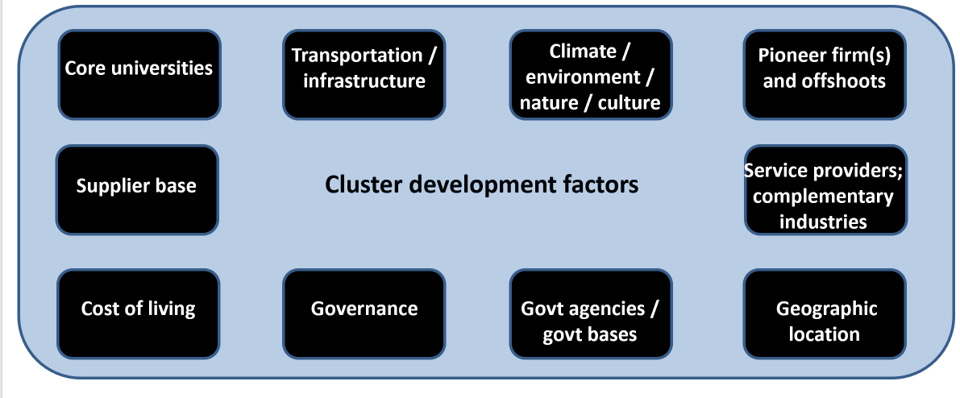

There’s getting in, and then there’s thriving and belonging, and that may be the harder part. In Clusters class we talk about immigrant culture as something shared by Silicon Valley and Shenzhen - could Japan - or a city in Japan - ever be described in that way? That, perhaps, is an interesting test. Below, our usual framework from class.

On the topic of administrative continuity: as fate would have it, METI now has a new minister, following a Cabinet reshuffle by PM Kishida, mere weeks after APEC. Tobias Harris (the Abe biographer and analyst, not the NBA player!) has coverage of the politics involved. It is a reminder that Cabinet ministers in Japan are also sitting members of the Diet, who serve as ministers at the discretion of the prime minister, who can form and dissolve a Cabinet. Thus, Rep Nishimura, who has held his Hyogo seat for 20 years, will likely remain an influential member of the Diet.

New METI Minister Saito promptly pledged to continue support for the semiconductor industry. I will also note that the support for entrepreneurship (such as sending entrepreneurs to SkyDeck!) highlighted in Minister Nishimura’s visit to the UC-Berkeley campus began under his predecessor.

A side-note on the implications of being a minister while also serving in the Diet - during APEC Week Minister Shindo Yoshitaka, who has CPTPP and startup policy in his portfolio, also visited the UC-Berkeley campus. He was in the Bay Area for all of 48 hours. Why? So as to be able to return for votes in the Diet.

Tis the season, and we as a family hewed to tradition by seeing the Adam Shulman Trio cover Vince Guaraldi’s Charlie Brown Christmas soundtrack, with some tracks from A Boy Named Charlie Brown thrown in for good measure. Shulman reminded a matinee audience, complete with kids, that Dave Brubeck had declined the gig that Guaraldi accepted. It’s a great jazz and pop culture what-if - imagine if Brubeck had penned Linus and Lucy - would it sound like your nerdy math instructor with a piano habit, as some of Brubeck does?

With that, I will end with my favorite track, the wonderfully onomatopoetic Skating.

Onward and upward,

Jon