Berkeley Asia Business Conference is back!

on April 30. plus, super blooms and Rakuten's cash needs

Friends -

At last, spring has sprung for real (did you hear it?) in the Bay Area. And, after countless atmospheric rivers, the various super blooms (WaPo gift link) across the state are visible from space.

Over the holiday weekend (April 9, the same day as my last post),

I took to the trails in Sonoma County and found a bit of the divine.

As Murakami Haruki wrote - 風の歌を聴け!

***

As an MBA/MA-Asian Studies student back at the turn of the millennium, I and a group of classmates founded what later became the Berkeley Asia Business Conference. The first installment was in March 2001. I ran up credit card debt on travel, including to Harvard’s Asia Conference to benchmark. (Where I exchanged cards with Jack Ma, who in public remarks told a compelling story about empowering lots of little fish - merchants - rather than chasing big fish. I still have his card tucked away somewhere.)

Late that February, when ticket sales were sluggish, I remember wondering if I’d have to run around Telegraph or Sproul with $20 bills to get people to fill the auditorium. Thankfully this was not required. Below, my co-chair Lawrence Low gives what I think were closing remarks.

It’s not the years, it’s the miles

Ta Lin Hsu and John Wadsworth keynoted that first year. We filled Andersen Auditorium and brought in enough support that I was able to pay down my credit card and leave a surplus for the 2002 team, led by Louisa Shen and Seong Chen.

So it brings great delight that a team of Berkeley MBAs — some of whom I have in Core Strategy during Spring B - has restarted the franchise. The 17th Berkeley Asia Business Conference will happen Sunday April 30 at the Haas School of Business. This year’s theme: From Asia to Asia. For more, here’s a post from Asia Business Club Co-President Mei Chen. Hope to see you there.

***

On Friday April 21, shares of Rakuten Bank debuted on the Tokyo Stock Exchange. Rakuten Group, the corporate parent, released 35% of its holdings with the listing, and raised $621M. This followed selling a 20% stake in Rakuten Securities to Mizuho in November. It also has been issuing bonds.

The need for cash comes after four years of capex funding a fourth mobile network operator in Japan. Not an MVNO, which Rakuten already had, but an MNO to compete with NTT, KDDI, and SoftBank. For this purpose, Rakuten hired Tareq Amin, the same network architect behind Reliance Jio’s very disruptive network deployment in India. And for that reason, I was very, very intrigued. Would Rakuten replicate the Reliance Jio playbook, in Japan? Yes, the part about a cloud-native, virtualized network is exciting, but I was curious, for example, if Rakuten would leverage the benefits of a greenfield network with no legacy overhang to provide service at cutthroat prices the way Reliance Jio did. And, most importantly, to what end? Meaning, what would be the synergy or benefit to Rakuten’s other business lines? On that subject, Rakuten describes about $300/year in GMS lift (basically, that much more in e-commerce sales) in its e-commerce business from mobile subscribers.

Rakuten IR, February 2023

MNO deployment has weighed on overall group profitability, as one would expect. Startup costs for a new MNO are easily above $10B just for the network. Japan has historically awarded spectrum, rather than auctioning it, so at least Rakuten has saved on spectrum acquisition costs. It has 1.7 GHz AWS spectrum, plus some high band spectrum.

Rakuten Group segment revenue and profit, in millions JPY

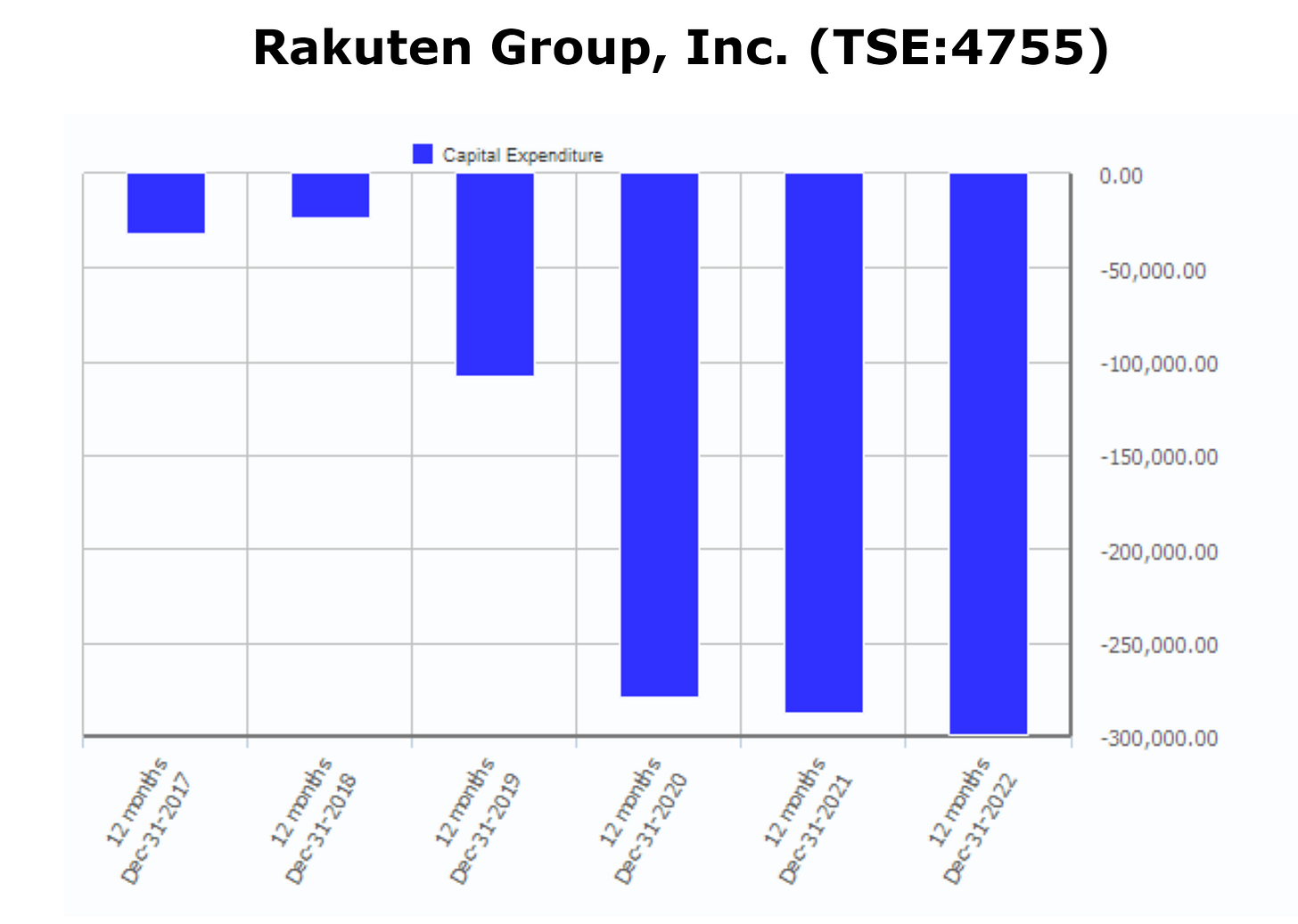

Capex is shown below. Assuming $1=JPY 130, that’s about $2.5B/year in capex, which is modest for a network operator (AT&T or Verizon usually spend $15B or so per year on network capex) but perhaps heavy for an Internet company that’s not Amazon.

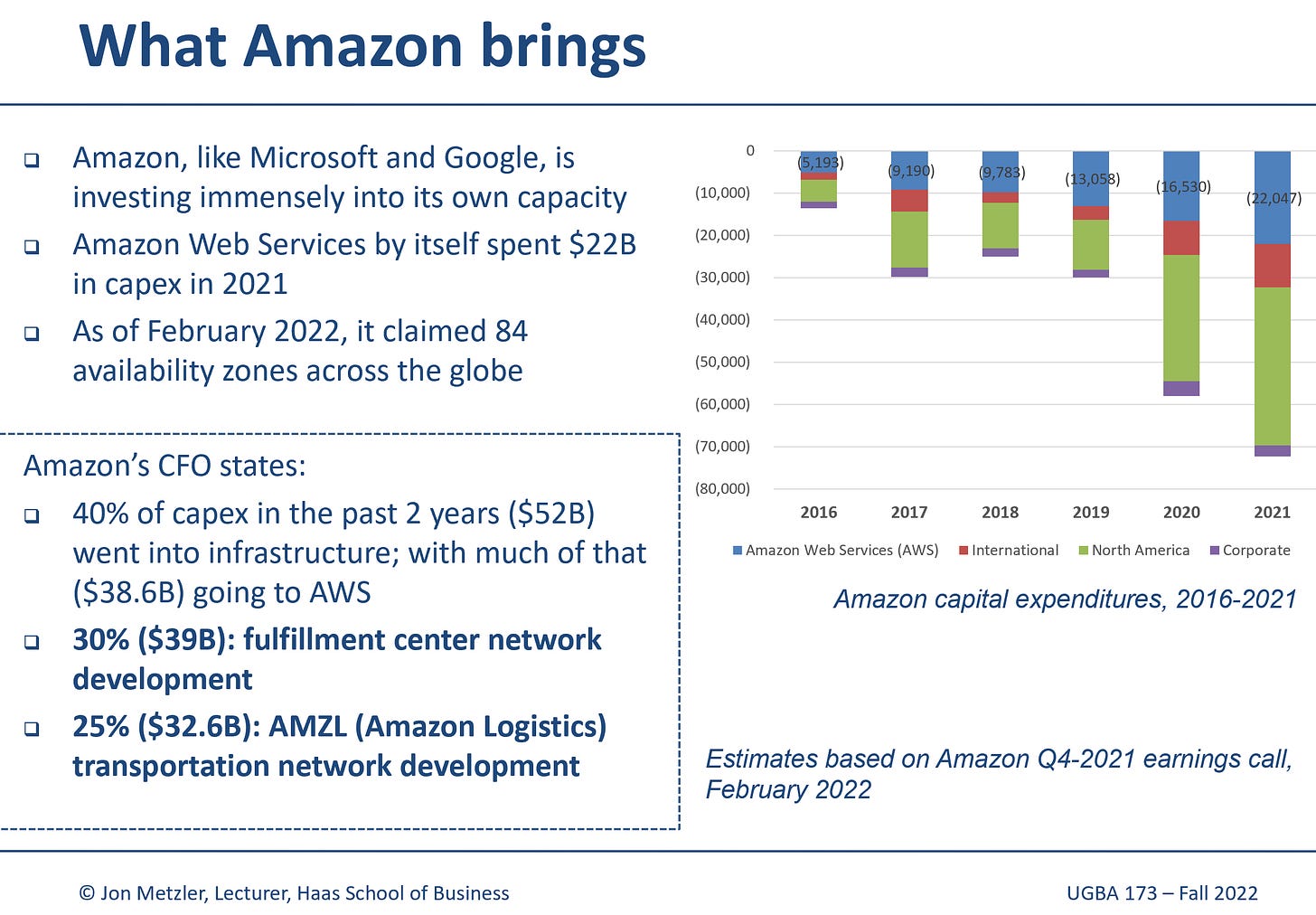

Which in a way highlights just how unique Amazon is, for example, in its revenue / capex flywheel. Below is Amazon capex from 2016-2021. Amazon spent $22B in AWS capex alone in 2021.

This affirms the value of AWS to the rest of Amazon - it throws off cash that Amazon can then deploy in its other businesses. So, perhaps that’s one potential success scenario for Rakuten Mobile - it eventually throws off cash, almost like dividend yield, that Rakuten can deploy elsewhere. That’s an if - if Rakuten can get through this first network build phase, and if it can get to critical mass of subscribers.

Looking back at Reliance Jio, our template for Rakuten: Reliance Jio has helped consolidate what had been a fragmented market, and as of 2021 passed Airtel for top market share. (I cover an Airtel case in Strategy for the Networked Economy.)

As of December 2022, Rakuten Mobile claimed 5M subscribers. Rakuten did emulate the Reliance Jio tactic of a free trial period. (Whether it lasted a year, as Reliance Jio’s apparently did according to some of my students, is something I need to confirm.) ARPU is a more respectable (if envy-inspiringly cheap from a US perspective) JPY2500/month, or about $20.

This is MVNO-level pricing from an MNO, per this comparison.

Rakuten is also projecting a decline in capex after FY2023.

From Rakuten February 2023 IR material

As of March 2022, Rakuten had 2.4% market share, and that presence seems to have resulted in modest declines in market share for the existing three operators.

My question is, despite the very reasonable prices (as I look at my Verizon bill): have they been disruptive enough?

Rakuten competitor SoftBank provides two past precedents, from when it entered the DSL business in the early 2000s, and in 2006, when it acquired Vodafone’s Japan business (previously J-Phone). In both cases, SoftBank cut prices and took market share. In the DSL case, SoftBank agents quite literally stood on street corners handing out home routers. As a frequent business traveler to Japan in 2002-03, I could have easily collected several home routers walking through the area around Hachiko in Shibuya. No questions were asked, and I recall politely declining offers of a Buffalo routers since I was a non-resident. Handing out routers to anyone with a pulse is aggressive subscriber acquisition.

5 million subs at around $240/year in ARPU is a $1.2B revenue/year business. Nice for an MVNO, but perhaps not all that meaningful for Rakuten, whose stated goal is to be the #1 MNO in Japan. (4/23 edit: The additional $300/year in GMS lift per subscriber implies an additional $1.5 billion in gross merchandise sold. ) Thus, I wouldn’t be surprised to see further cash needs to grow the MNO business in the future.

Onward and upward,

Jon