Friends - in Week 5 of Clusters class we hosted guest speaker Jared Stasik of Detroit Venture Partners. This is the second time Jared has graciously made the trip from Detroit back to his MBA alma mater to speak to a group of MBAs and public policy students. This year, like last, he spoke about the Detroit turnaround after emerging from municipal bankruptcy in 2014.

I had visited Jared in Detroit for the second time this summer as part of a trip around the Midwest, and this time took along a companion - my son, who like me in 2022 (see the embed below), got a walking tour of downtown with Jared, including of landmarks like the Guardian Building with the Michigan Mural.

The Michigan Mural at the Guardian Building

As class came to understand, Jared is a tireless ambassador on behalf of Detroit. It was great to host him again.

In class we discussed the mechanics of the municipal bankruptcy, and the subsequent turnaround-in-progress. One high level takeaway - cities are a collection of network effects writ physical, and that network effects can be both positive and negative, and if not arrested, can lead to systemic financial challenges - less money to invest, therefore disinvestment, therefore a less attractive city, therefore fewer residents, and so on.

There’s a second takeaway, one which is a core theme of Clusters class - that of human agency, before, during, and post-bankruptcy.

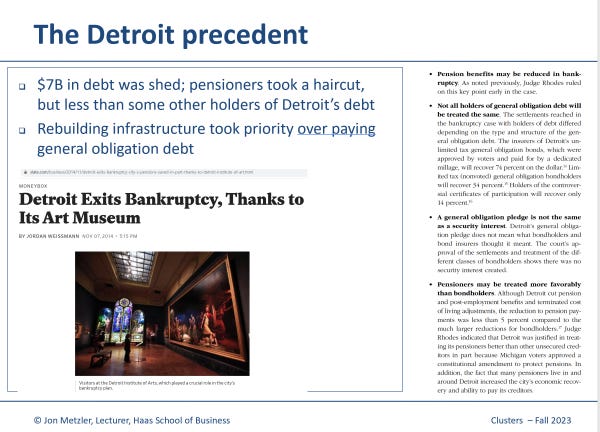

There’s a key precedent that Detroit helped set for other cities - that pensions, too, are a contract, and as such they are subject to review and negotiation and compromise during municipal bankruptcy proceedings. The Grand Bargain that came out of the Detroit bankruptcy largely prioritized pensioners, and the city’s need to be able to fund infrastructure post-bankruptcy, over certain debtholders. But the pensioners did ultimately take a haircut.

Here, resources I consulted (outside of our HBS case) include:

Detroit Resurrected: Nathan Bomey’s painstakingly reported chronicling of the bankruptcy

Michigan Bar Journal, 2015

The State and Local Recovery Plan issued by the city in 2021

But to other cities facing similar pressures (pension obligations as a growing share of city receipts) as Detroit has faced - say, my hometown of Chicago - Detroit set a profound precedent.

As we discussed in class, Detroit has not been alone in facing the pressures of de-industrialization and the broader US population’s shift south and west.

Note that the overall US population grew by around 175 million during the time shown above. That growth has mainly been outside of the Rust Belt.

It was a delight to host Jared again. Looking forward to my next visit to Detroit! I am hoping to attend Detroit Homecoming in fall 2024.

Time to shift gears a bit.

In 2020, with support from the UC-Berkeley Center for Long-Term Cybersecurity, I published Security Implications of 5G Networks. A lot happened over the three years I was working on it. Most profoundly, the geopolitics around wireless infrastructure fundamentally changed. Certain countries, such as US, moved to block Chinese infrastructure suppliers such as Huawei and ZTE. A consolidated market of infrastructure suppliers thus got more consolidated for operators for whom Huawei and ZTE were no longer candidates.

Telecom equipment market, 2019-2022, Dell’Oro, 2023

But back in 2017, I started with a couple of questions: (1) were operators ready for greater data heterogeneity? and (2) were they ready for the exposure that more small cell infrastructure (as necessitated by greater use of mid-band and high-band spectrum) would create?

From the executive summary back in September 2020:

The three types of spectrum band (high-band or mm-wave; mid-band; and low-band) allocated to 5G have different implications for network topology. Mid-band and high-band service will necessitate significant densification of operator networks. This densification may open greater operational and physical access risks than do traditional cellular networks. Further, the increase of cell sites required with network densification will require robust network monitoring capability, and the ability to update and patch software on small cells and customer premise equipment.

5G networks have at least three security benefits relative to prior generations: improved authentication; distributed core; and network slicing, dividing a single network into different “slices” while using the same wireless spectrum and physical network infrastructure. Realizing these benefits requires deploying both 5G RAN and 5G core. These benefits are compelling reasons for customers to investigate 5G-only service.

About three years on, US operators are indeed starting to market some of the standalone capabilities, such as network slicing. This is likely because at this point, over half of US mobile subscribers have 5G phones, enabling standalone 5G services.

The chart from GSMA below shows the wireless technology mix in North America in 2022, and estimates for 2030.

GSMA Mobile Economy, 2023

So three years on from that report, I’m happy to announce new research, again with support from the UC-Berkeley Center for Long-Term Cybersecurity, this time with a focus on Open RAN.

What is Open RAN, you ask? Open RAN is meant to facilitate greater interoperability of hardware and software in RAN or Radio Access Networks.

The diagram below from 3GPP (on the upper-right of the slide) lays this out in simplified form, dividing a 5G network into three elements: the customer’s phone (UE or user equipment below); NG-RAN or 5G RAN; and 5G Core. Traditionally, RAN and Core have been bundled by the same equipment provider and the interfaces between have been proprietary, maker-specific implementations.

Operators that have deployed Open RAN meaningfully include Rakuten Mobile, a greenfield operator in Japan with about 5 million subscribers; and Dish, at a more interim level, here in the US. (Reliance Jio, like Rakuten, is the rare greenfield operator and shares bloodlines with Rakuten, but is not an Open RAN deployment, per se. Yet.)

So-called brownfield or operators with incumbent RAN deployments are in varying states of assessment (as this collection of articles from RCR Wireless shows).

Part of my interest in Open RAN is sparked by the level of government interest in it . In May 2023, NTIA, prior to a meeting of the Quad, issued a report stating the Open RAN fundamentally doesn’t alter the security risk landscape for RAN, and that if anything, the openness that Open RAN could facilitate could be a benefit from a security perspective.

Quad Open RAN Security Report outline, May 2023

The logic here is evocative of that for both the cloud (distributed, resilient, not silo’ed, on-prem) and open-source software (more eyes = fewer bugs).

I am working towards summer 2024 publication via CLTC, and shared an interim deliverable at a recent exchange held by the Berkeley APEC Study Center and Berkeley Risk and Security Lab. Thanks to Vinod Aggarwal and Andrew Reddie for having me at that event, and thanks to UCB CLTC for the support.

Onward and upward,

Jon