Transitions take time

an ode to policy coherence

Friends - time has flown. We’ve had a rich stretch of programming, both at Haas and on the broader Berkeley campus, which collectively have been a reminder of the power of community and connections. Below are some highlights:

January 31: Jensen Huang, CEO of NVIDIA.

Huang came to campus on a Tuesday evening. When the CEO of NVIDIA comes to campus…you go. I teach Tuesday nights in the spring. (On this night, we tackled the Bharti Airtel case.) This was a day when students had a legit excuse to straggle into class late - if they had gone to his talk.

Huang memorably described NVIDIA as the *last* computer graphics company founded, which was a reminder of the consolidation that’s happened in semiconductors since. And it’s striking to think that the company used to power a host of applications today (from ChatGPT to image recognition systems) was first founded to provide video cards for PC gaming, which, of course, it still does. He also noted he’s the longest serving tech CEO today, having served as CEO since NVIDIA’s inception in 1993.

Alas, I had to leave early, as instructors need to be on time for class. Huang’s comment that ChatGPT represents an iPhone moment for AI seems to have gotten some traction. There’s something to the analogy, given the breadth of experimentation ChatGPT has elicited. (Historical note: the iTunes App Store launched with the 3G iPhone in 2008, not the initial iPhone in 2007.)

**

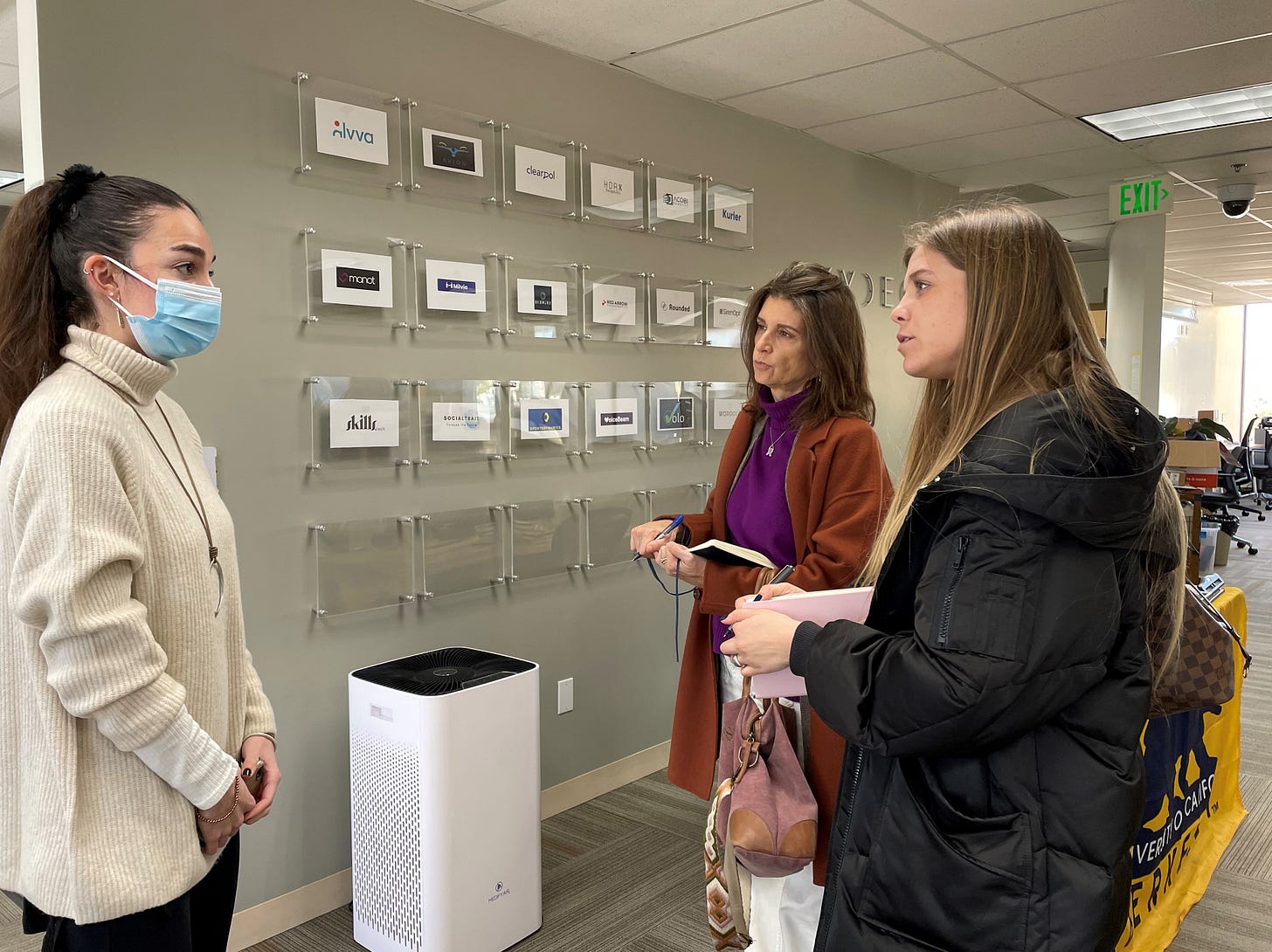

It was also nice to welcome Paula and Barbara from the Finaves Fund at IESE to the UC-Berkeley campus and to Berkeley SkyDeck that same day. (hat-tip to Liz Kerton for the intro.) That’s Ekin Gunaysu, innovation program manager from SkyDeck, answering the harder questions.

February 8: Berkeley SkyDeck Innovation Partner Program demo day

I have been delighted that for two years SkyDeck has provided its acceleration program to startups from Japan, in partnership with JETRO, which sits under Japan’s METI and has a two-way mission of promoting inbound and outbound trade. More broadly SkyDeck supports an array of international partners. Demo Day for a cohort of startups from Japan, Taiwan and Armenia was February 8. The team at web3 contract management provider Final Aim was voted “most likely next unicorn”. Here’s the team at the Japan Society Gala last November with Yotetsu Hayashi, new head of JETRO San Francisco.

Gala fancy, November 2022

February 14: Haas economics professors Catherine Wolfram and Ulrike Malmendier, in conversation with Dean Ann Harrison

There’s a long history of Berkeley economics faculty going into public service, albeit mainly in Democratic administrations in the US. (As an MBA taking macroeconomics back in 2000, our professor was Janet Yellen, who was back after serving in the Clinton Administration, in the interregnum before she went to the Fed. Microeconomics was taught by Carl Shapiro, back from antitrust work at the DoJ.) Professors Wolfram and Malmendier shared their experiences on leaving the academy to go into public service, respectively in the Biden and Scholz administrations.

Economists talking public service? There was a full house for this. Clearly, Berkeley students have public service on their minds.

In non-public programming, Christina Romer, who left Haas in 2008 to serve in the Obama-era Council of Economic Advisors during the Great Recession, guest-spoke to first-year full-time MBAs in core Macroeconomics. I had the opportunity to observe (thank you to Prof Bombardini). I was reminded anew how quickly we went from what’s the right level of stimulus? (answer at the time: $787 billion) to the sequester Budget Control Act of 2011. Below is what that meant to federal research funding at the time.

And then there was the government shutdown of fall 2013.

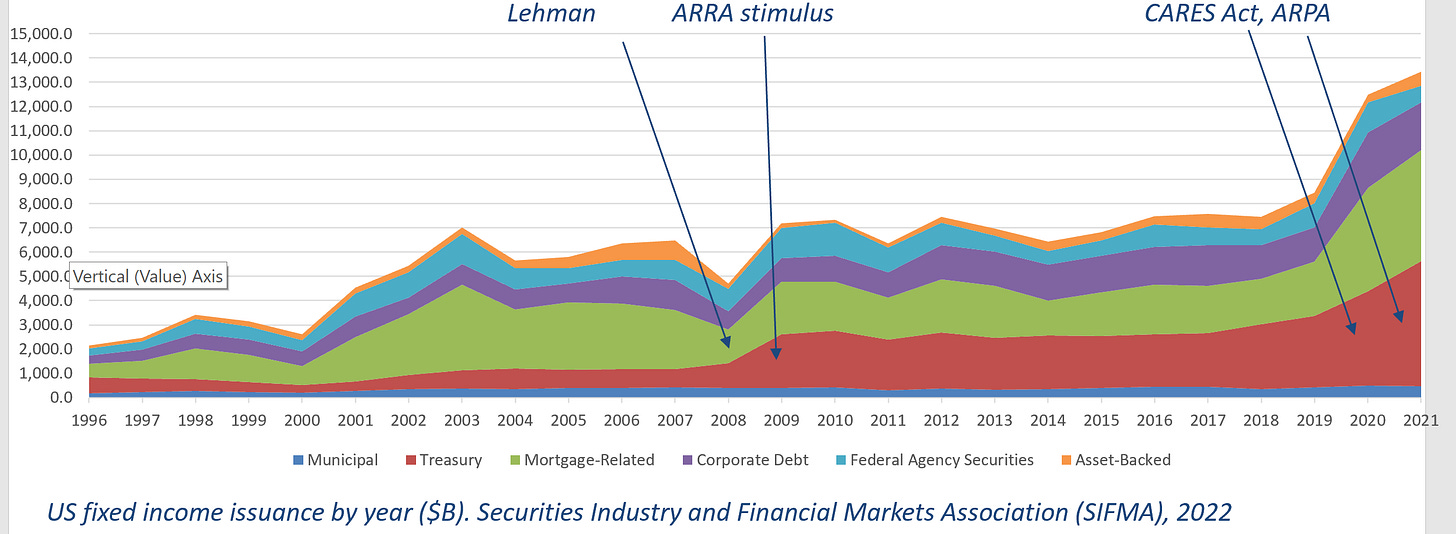

Looking at the fixed income market, we see a similar rise and dip with the ARRA Stimulus and sequester, and spike in Treasuries with the three pandemic-era stimulus packages, two of which are reflected in the data below, covering the span from 1996-2021.

There’s a broader insight here about policy coherence and continuity. Elections matter, of course, and the sequester was a consequence of Republicans gaining control of the lower chamber of Congress after the 2010 midterms. Sound familiar?

We’ve gone from stimulus to inflation, and various reporting would attribute 30% of inflation in the US to excessive stimulus. So the issue the Obama-era CEA faced of swinging to austerity before stimulus can really take hold doesn’t apply. The increases in the federal funds rate over the past year, juxtaposed with historically low unemployment, highlight this.

But where coherence will matter is in our new new era of industrial policy, which I’ll use broadly to cover reshoring, friend-shoring, or the energy transition targeted by the IRA, or the regional collaboration (in the form of the Quad or Fab 4) being promoted by the State Department, as referenced in my last newsletter.

The industry fields being targeted by the IRA and CHIPS Act all require long-term, consistent investment.

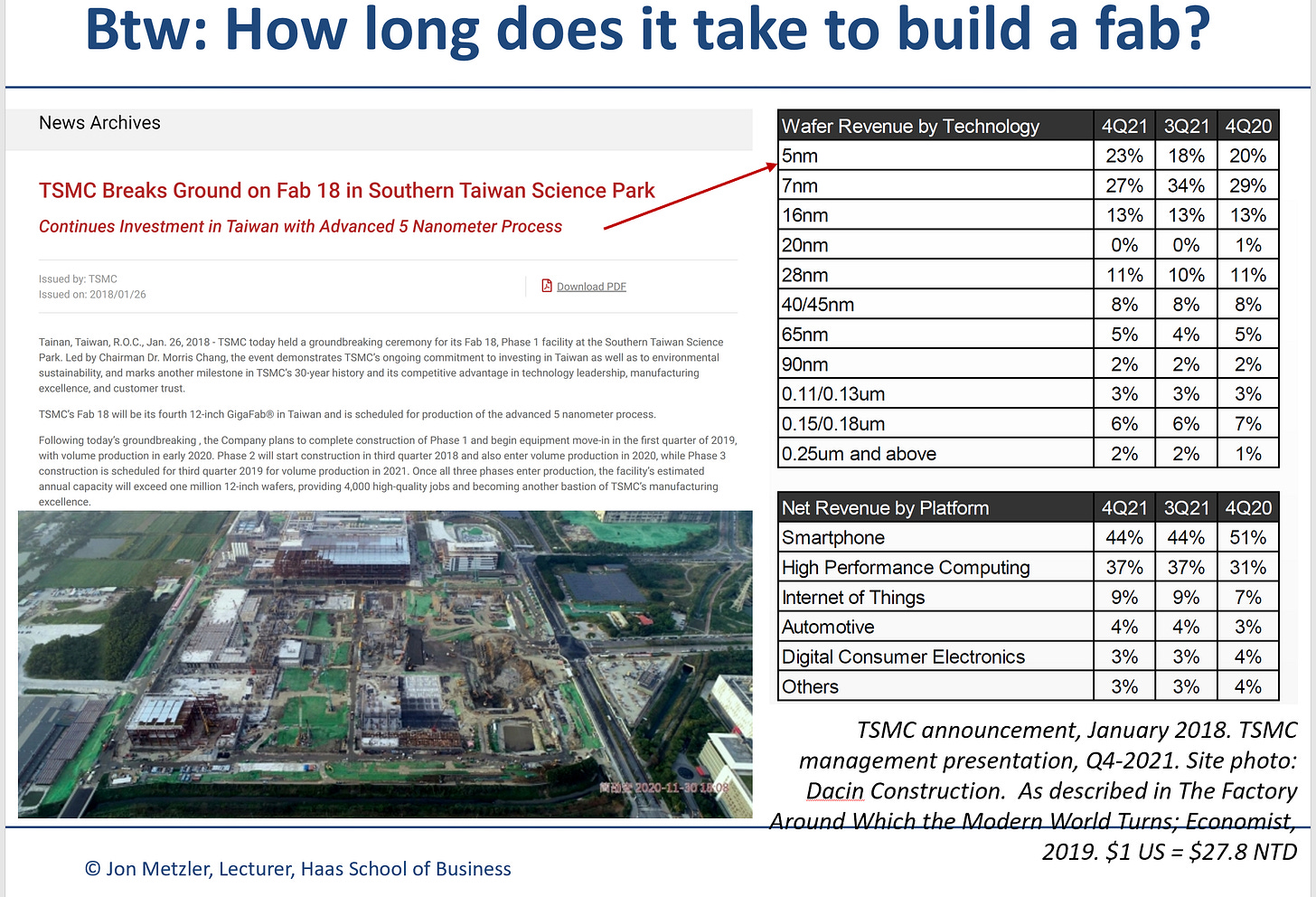

A chunk of the CHIPS Act, for example, will go towards helping Intel build a fab near Columbus, Ohio. How long does it take to build a fab? TSMC’s Fab 18 - for the then-new 5 nm process - in Tainan, Taiwan, for example, took about 3 years to build and TSMC is probably the best company in the world at building a fab and does in a very collaborative environment.

So how long will it take Intel in Ohio? And that’s just one project.

While the CHIPS Act passed both chambers of Congress on a (relatively) bipartisan basis, IRA passed on a party line vote through budget reconciliation, and was centered around incentives (carrots, rather than sticks), primarily to get the approval of one senator’s vote, as Professor Wolfram noted. The chart below is from McKinsey.

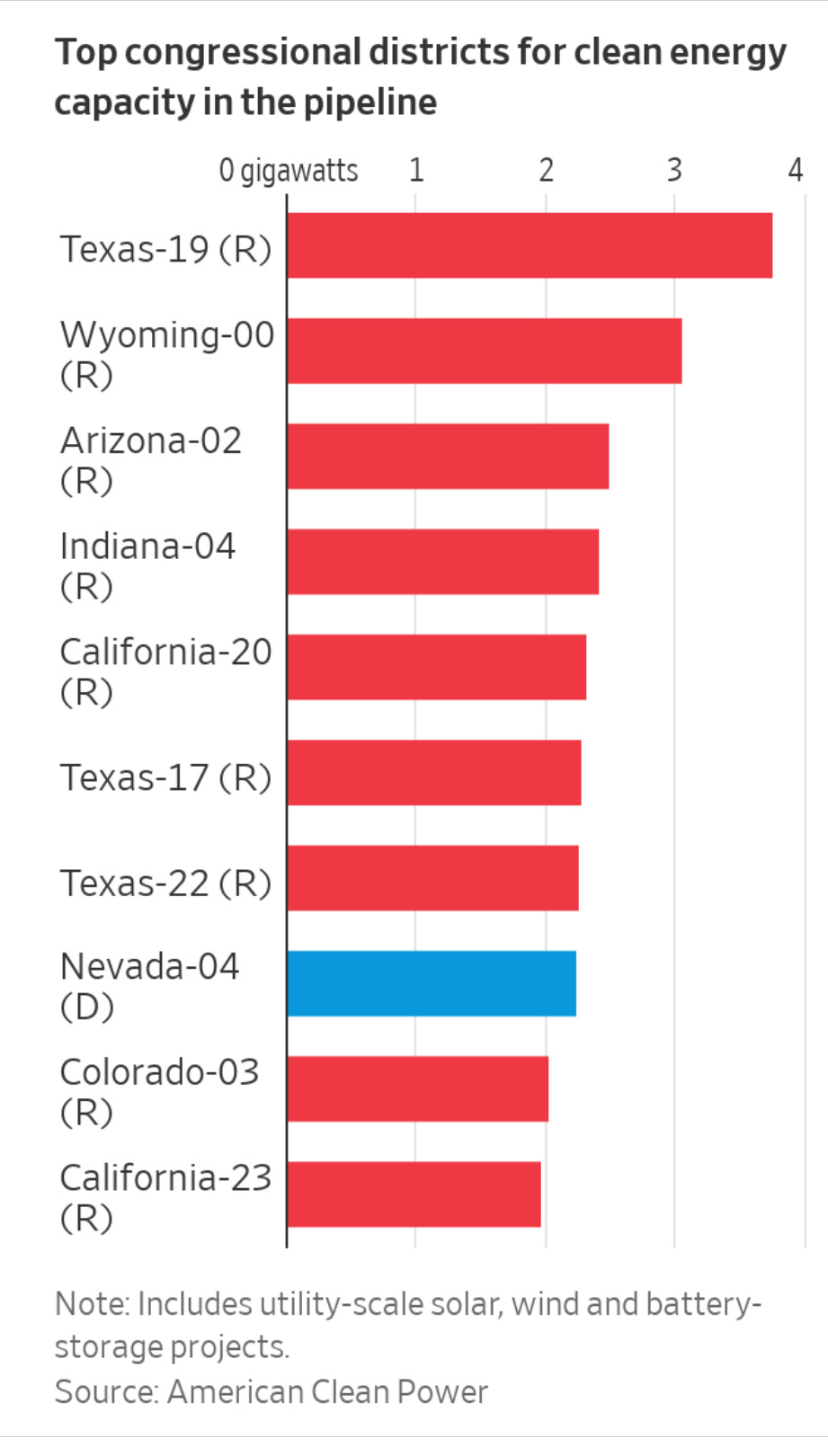

The WSJ, with information from the Clean Power Association, categorized clean power project pipeline by state post-IRA. (For some reason, states are sorted as Red or Blue.)

Of course, some states are sunnier or windier than others, regardless of who is in charge and what the incentives are. But generally speaking, capital investment requires a consistent, stable policy environment. If industrial policy really is back, then policy coherence will also need to make a comeback too.

**

Reads and Listens

Sarah Lubman in NatGeo: Japan confronts a stark reality: a nation of old people

This was riveting. Lubman then appeared in a Zoominar (The Leading Edge of Aging: Lessons from Japan) hosted by UCSD’s Ulrike Schaede. (I have just finished Schaede’s 2022 work, The Digital Transformation and Japan’s Political Economy, with co-author Kay Shimizu, which explores the collision of Japan’s demographics and its digital transformation.)

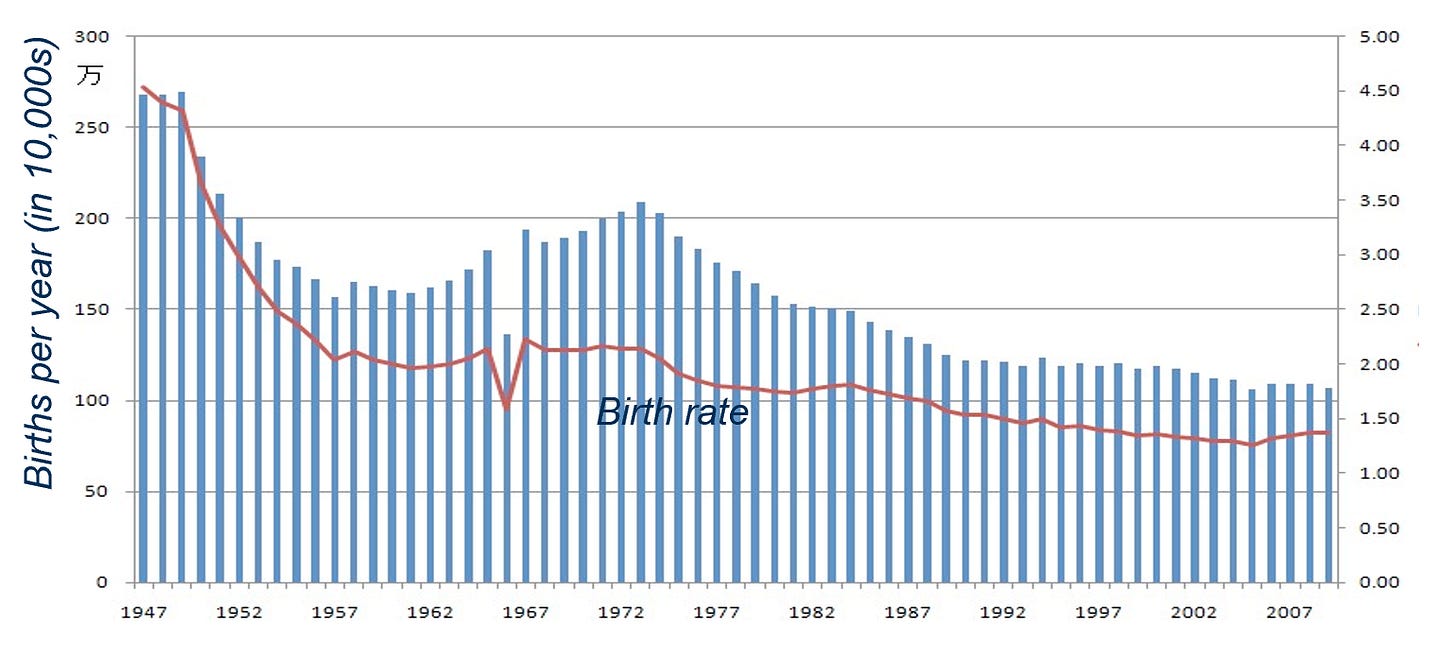

I’ll supplement one point in Lubman’s article - Japan’s population structure today was 50 years in the making, as the birth rate dipped below replacement in 1974, during the oil shocks. (The 1966 dip can also be seen in population data for China - apparently 1966 was an inauspicious year for Zodiac reasons.)

Unsiloed Podcast with Greg La Blanc with guest Tom Wheeler

Here, a shout-out to my faculty colleague, the ever-energetic Greg La Blanc. Greg is now on episode 246 of his Unsiloed Podcast, powered by the folks at alumni.fm. For episode 244 he had former FCC Chair (and former CTIA head, and investor, and author/historian) Tom Wheeler, now with the Brookings Institute. I have not read Wheeler’s latest book yet, but Mr Lincoln’s T-Mails, on Lincoln’s use of the telegraph in the Civil War, is wonderful. Wheeler’s conversation with Greg is fantastic.

Robots Won’t Save Japan, by James Wright

I’d been eagerly awaiting Wright’s book after reading an excerpt in Technology Review. I’m now in mid-read of Wright’s ethnography of elder care automation.

In personal wellness news, I’m two weeks out of the sling, which means I’m about 30% through (8 weeks out of 26) rotator cuff rehab. The milestones are incremental and steady.

Onward and upward!

Jon