Back to school, fall 2024 edition

plus: talking semis at SkyDeck; Detroit Homecoming; and Intel

Updated post-publication - had shipped in a not-quite-finished state

Friends - was that a hint of fall in the air this weekend in NorCal? Hard to believe we already through week 3 of the fall semester at Cal. It’s been great to feel the pulse of the campus after the relative quiet of summer. This past week the sky was Cal blue, and the light on the Campanile was just so, and I may have channeled my inner Ernie Banks.

This fall’s lineup:

Strategy for the Networked Economy, undergrad version (for the first time since 2019)

Opportunity Recognition: Technology & Entrepreneurship in Silicon Valley, for mainly MBAs (for the first time, as described here)

In Year 11 of teaching, it has been a lot of fun to plunge back into electives, and engage in really thoughtful conversations with motivated students.

In particular, preparation for Opportunity Recognition was a catalyst to look at how Silicon Valley has changed in the nearly 25 years since the course was first launched. Some of the Magnificent 7 (Meta, Tesla) didn’t exist; NVIDIA had just gone public; Google was still in its early days. The name partners at A16Z were working on Loudcloud. iOS, Android, and global platforms that allow blitzscaling and being in the billion user club were years in the future.

So in preparing, I consulted resources old and new(er).

While much has changed in the environment - other regional hubs (fellow clusters of innovation, whether Austin or Seattle or Pittsburgh or Raleigh-Durham or outside of the US) have developed, and venture capital itself has globalized - what Silicon Valley remains uniquely good at remains consistent - that the combined infrastructure of capital, service providers, mentors, and culture remains singularly good at launching and scaling innovation. Very excited about the rest of this semester!

It was a delight to host

, author of the newsletter at Berkeley SkyDeck last week. Austin, thanks for coming to see us. I was joined by Mark Miller, one of the key advisors for the chip track at SkyDeck. We had a fun discussion on where startups can play, given the capital requirements to scale chip companies, and the capital barriers to getting fab capacity at the leading edge.Austin Lyons and SkyDeck chip track mentor Mark Miller

Speaking of SkyDeck, Demo Day for Batch 18 (the 18th cohort) is Tuesday October 1 from 2:30-6pm at Zellerbach Hall!

Austin’s visit to SkyDeck follows a visit to campus by

, curator of the . Jon came to campus in February. has been coming to campus for years (often enough that I might need to get Jay a badge). Can be far behind? ? ?Looking ahead - I am looking forward to attending the 11th Detroit Homecoming (with a wingman!) this week. Having visited Detroit during the summer in 2022 and 2023, this year I am delighted to time the visit with the annual Crain’s event and to see the newly renovated and re-opened Michigan Central Station. I stopped by during the renovation in 2022.

Looking forward to getting back out and seeing (yet again) the Detroit revival!

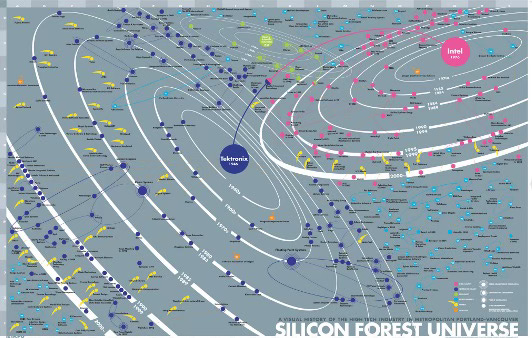

Back to semiconductors. Back in August, I had opportunity to speak with Kyra Buckley, reporter at Oregon Public Broadcasting, about the news that Intel would be laying off 15,000 employees. Intel is the biggest employer (4% of state employment) in the state, and anchor employer in the Silicon Forest that derives Intel (in Oregon since 1974, with Intel’s biggest employment footprint in any US state) and Tektronix (founded in 1947) at its center.

Silicon Forest Universe: Portland State University & Virginia Tech, 2005

To Kyra’s pointed question - are the layoffs indicative of a broader downturn in the semiconductor industry, or really about Intel? My response was - alas, this is more about Intel. I will refer readers to

estimates of how much more external cash Intel may need to get to 14A - ~$28 billion. This is due to the falloff in revenue in product, leading to shortfalls in cash flow (link to Austin’s post on the IDM death spiral), and the costs of trying to get through 5N4Y in a hurry. ’s analysis from April 2024 pre-dates the recent news, but helps highlight the financial hole Intel is in.So who will step up? Or, as we will discuss in class - who else - besides Intel (and the US government, and the state of Ohio) - really wants Intel (and in particular, Foundry) to succeed? Those who have priority access to TSMC (e.g. Apple and NVIDIA) will not be quick to raise their hands. But, we second Jay’s point - there are reasons beyond national security for the semiconductor industry to want an alternative to TSMC.

With that, I will close with a view from the trails this weekend.

Onward and upward!

Jon

Exciting to hear that the undergrad class is back - and: inevitably - better, Professor Metzler; it truly changed the trajectory of my career. Keep Connect posted on how it goes, and have a great Fall semester! :)