Friends - it’s been a minute! The semester is flying by - one section of Strategy for Networked Economy just completed Week 8; another completed Week 7; and a block week version of Opportunity Recognition might just be… about to drop. (Spring break? What’s that??)

Last time I was in your inbox it was to announce that two years after getting started, my report on Open RAN, published with support from the UC-Berkeley Center for Long-Term Cybersecurity, was available for download!

And just in time - as fate would have it, Open RAN was on the docket during Prime Minister Ishiba’s visit to Washington in February.

The US-Japan joint leaders statement issued referenced Open RAN, stating:

As part of such cooperation, the two leaders intend to advance multilayered and aligned cooperation among like-minded countries, including Japan-Australia-India-U.S. (Quad), Japan-U.S.-Republic of Korea (ROK), Japan-U.S.-Australia, and Japan-U.S.-Philippines. Through these relationships, the United States, Japan, and like-minded partners can deliver high quality infrastructure investments in the region, including the deployment of Open Radio Access Networks in third countries.

Open RAN was on the docket again at an Asia Society meeting of the Quad (Australia, India, Japan) consuls general in San Francisco, later in February.

March 12 was the Zoom where it happened, when the Center for Long-Term Cybersecurity hosted a webinar on "Exploring Open RAN’s Role in Transforming Telecom".

It was a delight to join Chris Boyer of AT&T, David Jeppsen of NTT, Art King of Cohere Technologies, Doug Kirkpatrick of Eridan, some of whom were fresh back from Barcelona and Mobile World Congress. Thanks to Berkeley Risk and Security Lab lab director Leah Walker for moderating.

It was also great to see various members of Bay Area consulates, including Japan, the Republic of Korea, and the Philippines.

Live from NorCal, Washington, the PNW, and beyond….

The CLTC webinar - and my report's publication - came at an interesting time in the market:

the RAN (Radio Access Network) market is going through a contraction after initial 5G rollouts in advanced wireless markets

Open RAN itself is morphing from a movement (to unbundle the RAN) or something harnessed by greenfield entrants (e.g. Rakuten or DISH) to more of a flexible feature set, usable not just by new entrants but by incumbents too (or, as Ericsson or Nokia might say, they make Open RAN kit too)

With 5G penetration above 50% in many advanced markets the time has come to look ahead, and multiple governments are putting a stake in the ground to try and claim 6G leadership (hence Cohere Technologies’ presence in the webinar)

As discussed during the webinar - yes, defining interfaces to the RAN more precisely (as done by the O-RAN Alliance) creates new vectors of risk by definition; but it also facilitates interoperability, should a supplier face challenges.

Our webinar came about 5 years after then-Attorney General Bill Barr floated the idea of the US government investing in Nokia or Ericsson. While that thankfully did not come to pass - it is not a coincidence that a mere four months after that, Chris Boyer, one of our panelists, helped launch the Open RAN Policy Coalition, in May 2020.

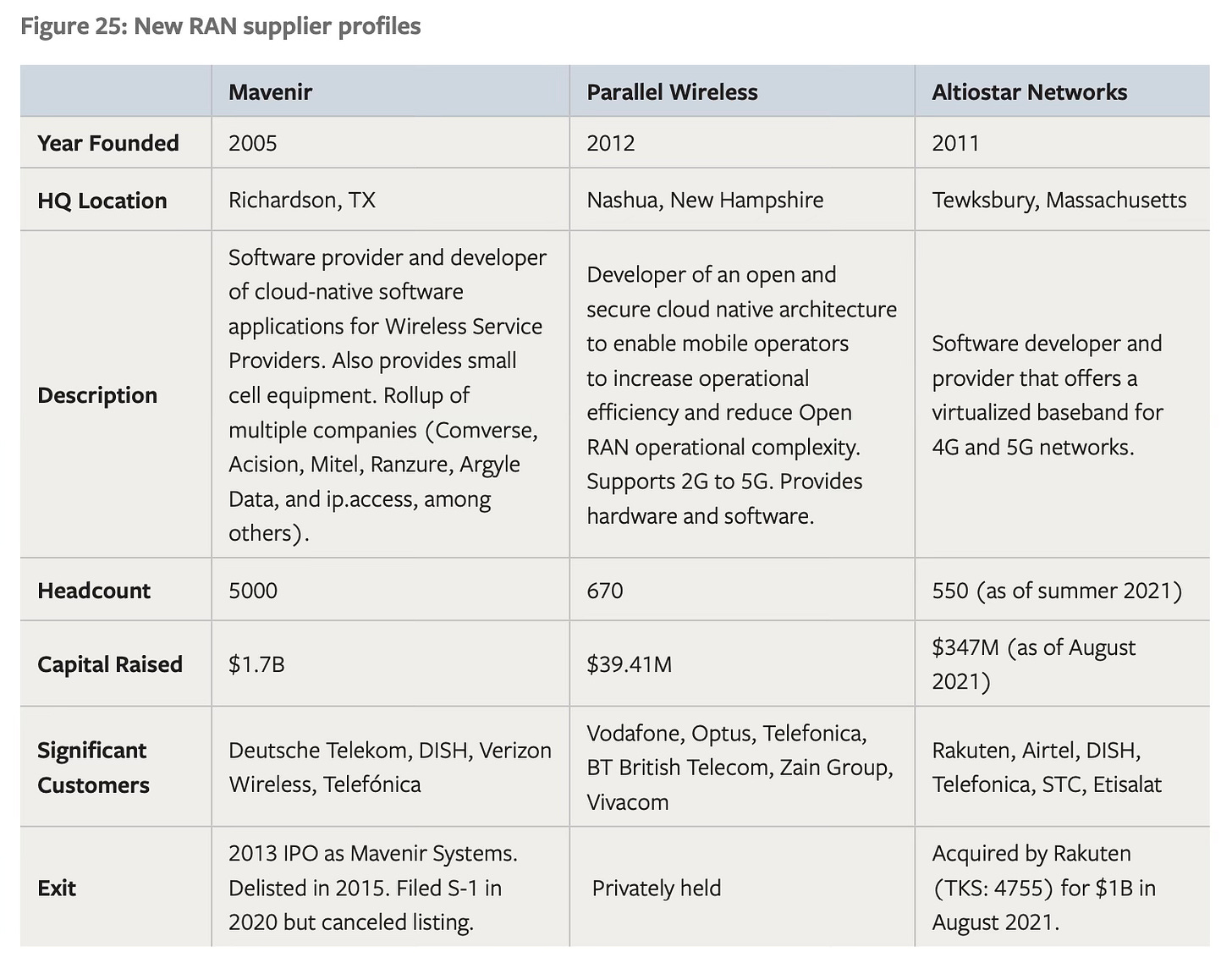

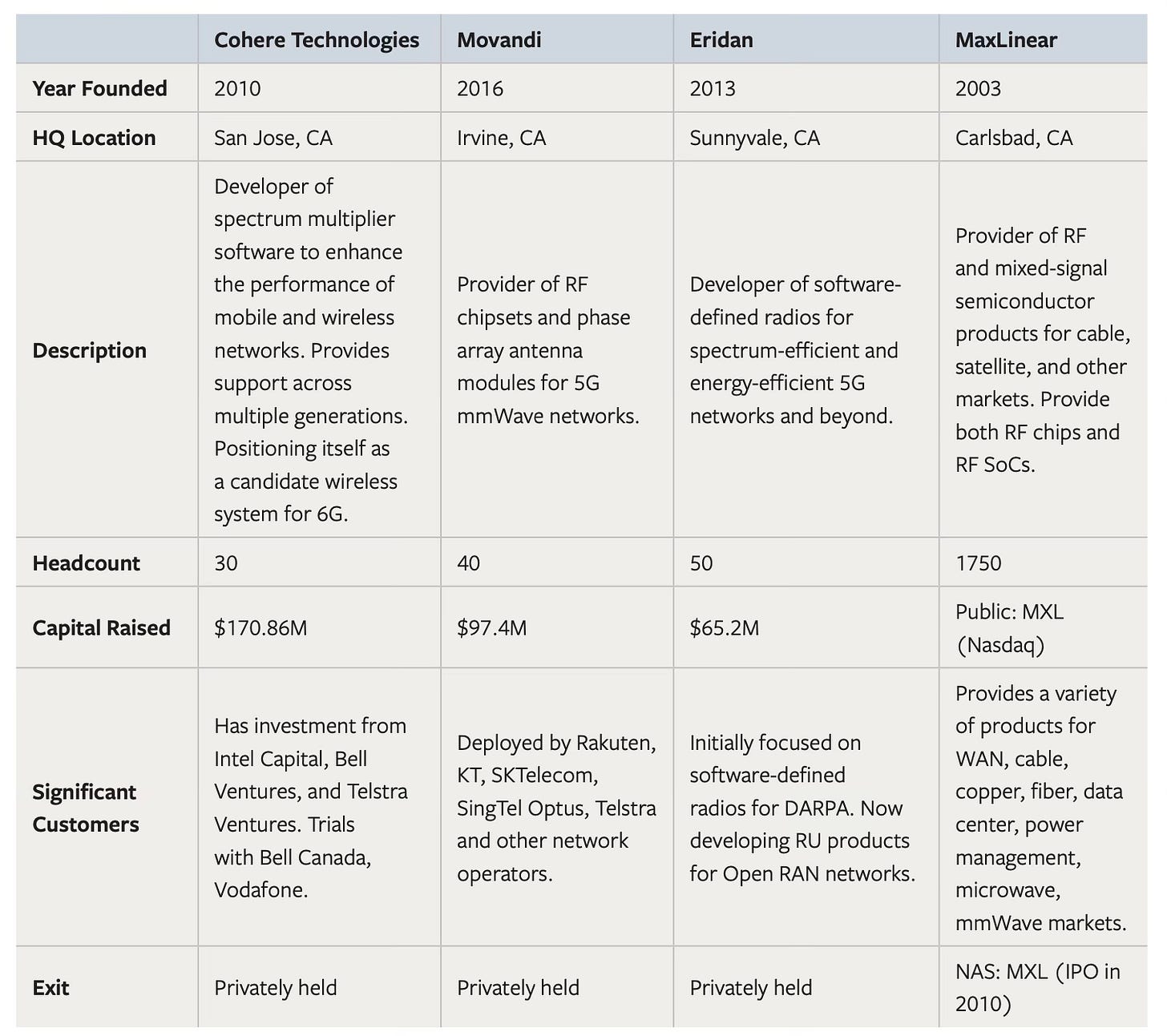

Cohere and Eridan were among several newer (relative to, say, Nokia or NEC) suppliers I introduced the report. I’m excerpting those tables here.

Being a smaller RAN supplier isn’t easy - Airspan (not profiled) just exited Chapter 11, and similar rumors have swirled around Mavenir for some time. Despite being in Chapter 11, Airspan did still secure $42.7M in funding from NTIA for Open Radio Unit development in January 2025.

In my preamble to the webinar, I shared three significant takeaways from the report:

Meta, through its Telecom Infra Project; China Mobile (through the C-RAN Alliance, now part of the O-RAN Alliance); the US Government; and Rakuten all looked at the state of the RAN and saw opportunities in disaggregating the RAN. This gets to our eyes-of-the-beholder takeaway;

New wireless suppliers have to navigate multiple timelines:

network generational upgrades (every ten years with a mid-generation upgrade in the middle);

slow operator testing cycles (18-24 months); and then

their own incubation cycle of 7-10 years. Founding a wireless infrastructure takes bravery, fortitude and patience. Nurturing them takes time and consistency;

Thirdly, influencing supply in the RAN wouldn’t take that much money. To wit:

US operators might spend $40-45B in a heavy year on capex, one-third on RAN equipment. So maybe $15B per year, in total, in a heavy year in the US market.

The RAN market itself is 40B in a $100B telecom equipment market. Would public inducements help shape that? It sure would help nurture newer suppliers if public funds were consistently available, or consistent public-private matchings of funds that gave incentive to adopt newer or open architectures. In the webinar, I recommended that NTIA’s Public Wireless Supply Chain Innovation Fund be renewed multiple times over.

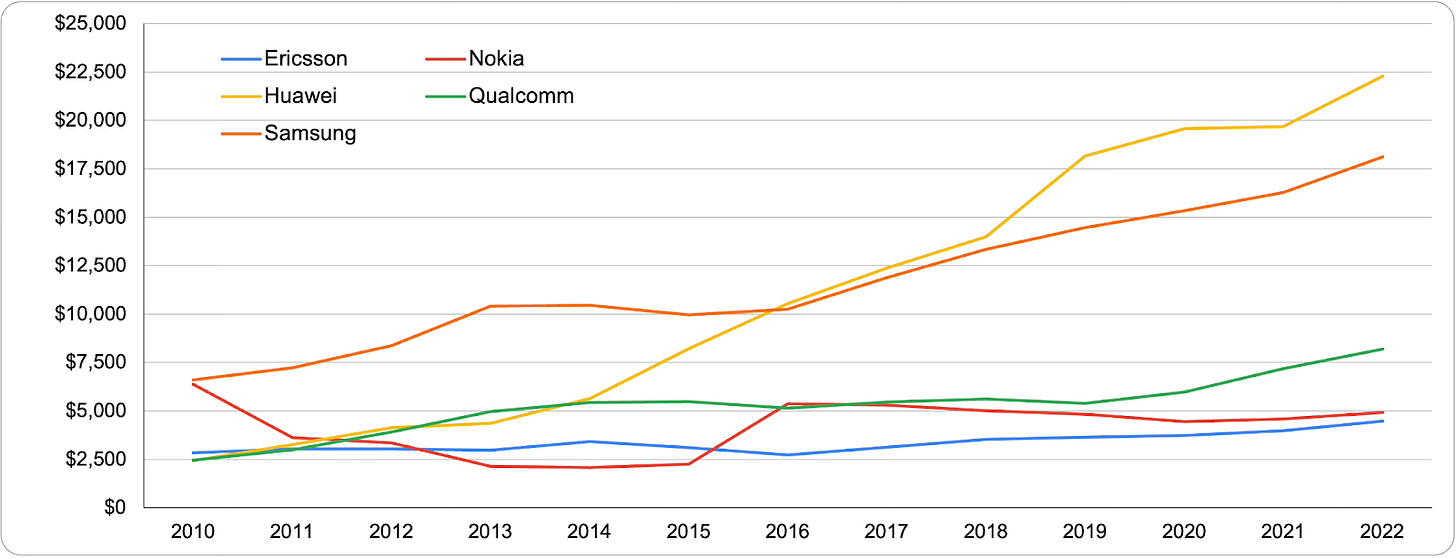

The corollary to that argument, of course, is that governments would have to be consistent - in a decades-span kind of way, not a 2-year or 4-year kind of way - in the way that RAN suppliers have in their investment (or go really big at once, a la Operation Warp Speed). Below are trailing R&D expenditures (2010-2012) for Ericsson, Huawei, Nokia, Qualcomm and Samsung. (Yes, Huawei and Samsung are bigger and more diversified than Nokia and Ericsson, so not apples-to-apples. But, as a share of revenue, Nokia spends 18-20% on R&D.)

Missed the report? CLTC’s Rachel Wesen closed our webinar with the link.

Yours in staying connected,

Jon

PS - the mail took its sweet time, but at last, a bundle arrived with these:

PPS: in the theme of this point, I’m going turn-of-the-1990s with this one: