Open RAN report is out!

recommendations for network operators, policymakers; lessons from Salt Typhoon; and more

Friends,

From mid-2022 heading into mid-2023 I picked up an interesting sequence of signals.

As of 2022q2, Verizon was at almost 50% 5G penetration in its subscriber base. With 5G at critical mass, standalone 5G should follow, as should the beginning of work on defining what 6G should mean.

Rakuten continued a sequence of listings and debt issuances so as to fund rollout of Rakuten Mobile, a virtualized 4G/5G network in Japan. It listed shares in Rakuten Bank in April 2023. The significance of Rakuten Mobile - it’s the rare 4G/5G greenfield network operator, and one that leverages network virtualization techniques.

In April 2023, the White House National Security Council issued its principles for 6G, including that 6G networks should be "open and resilient by design".

In May 2023, Open RAN was on the agenda at a meeting of the Quad - leaders from Australia, India, Japan and the United States. The US, through NTIA, issued a report outlining "cybersecurity considerations associated with using Open Radio Access Networks (Open RAN)".

So, starting from RSA San Francisco in spring 2023, I began work on my second report for the UC-Berkeley Center for Long-Term Cybersecurity, on Impacts of Open Radio Access Networks for Operators, Policymakers, and Consumers. This follows on report on Security Implications of 5G Networks, released in fall 2020.

I am happy to share the report on Open RAN is now available for download from UC-Berkeley Center for Long-Term Cybersecurity’s website! So please check it out. I look forward to your comments and feedback.

I am, of course, available for briefings for those interested.

Thanks again to the CLTC team of Ann Cleaveland, Chris Hoofnagle, Chuck Kapelke, Matthew Nagamine and Rachel Wesen!

Thanks also to my former student Jenny Han, who provided excellent research support.

Vinod Aggarwal, Claudio Petti, Andrew Reddie, and Leah Walker reviewed a preliminary version of this paper in fall 2023.

In working on the report from spring 2023 to the end of 2024, I set out to address the following questions:

What is the significance of Open RAN for network operators that are making 5G supplier decisions, or that are beginning planning for 6G?

What is the current state of supply in the RAN? What actions can policymakers take to facilitate supplier diversity in the RAN? What would be the consequences of lack of action, or sporadic action?

At a higher level, what is the significance and benefit of innovation in the RAN?

As I got to writing, this did have a bit of pulling-on-a-thread effect (in true if you give a mouse a cookie fashion; parents, I see you nodding your heads):

assessing the value of unbundling the RAN first meant defining the RAN, and the relationship of co-specialization between RAN suppliers and network operators

assessing Open RAN interfaces, and any incremental risks thereof, meant first clarifying interfaces defined by 3GPP and others, and the risk of more clearly defining interfaces versus that of keeping some interfaces monolithic

If you’re going to unbundle the RAN, who re-bundles it? This can be the network operator itself; a specialist service provider partner; or a network equipment supplier (e.g. Ericsson or Nokia) on a managed service relationship

And, assessing policymaker actions to induce new suppliers meant also characterizing the RAN supplier maturation cycle, network operator assessment processes, and also the relationship between “prime” suppliers and new(er) suppliers

Just how big is the RAN market, and telecom equipment market, anyway? And, what is the value of robust network connectivity to society? In sum, why does innovation in the RAN matter?

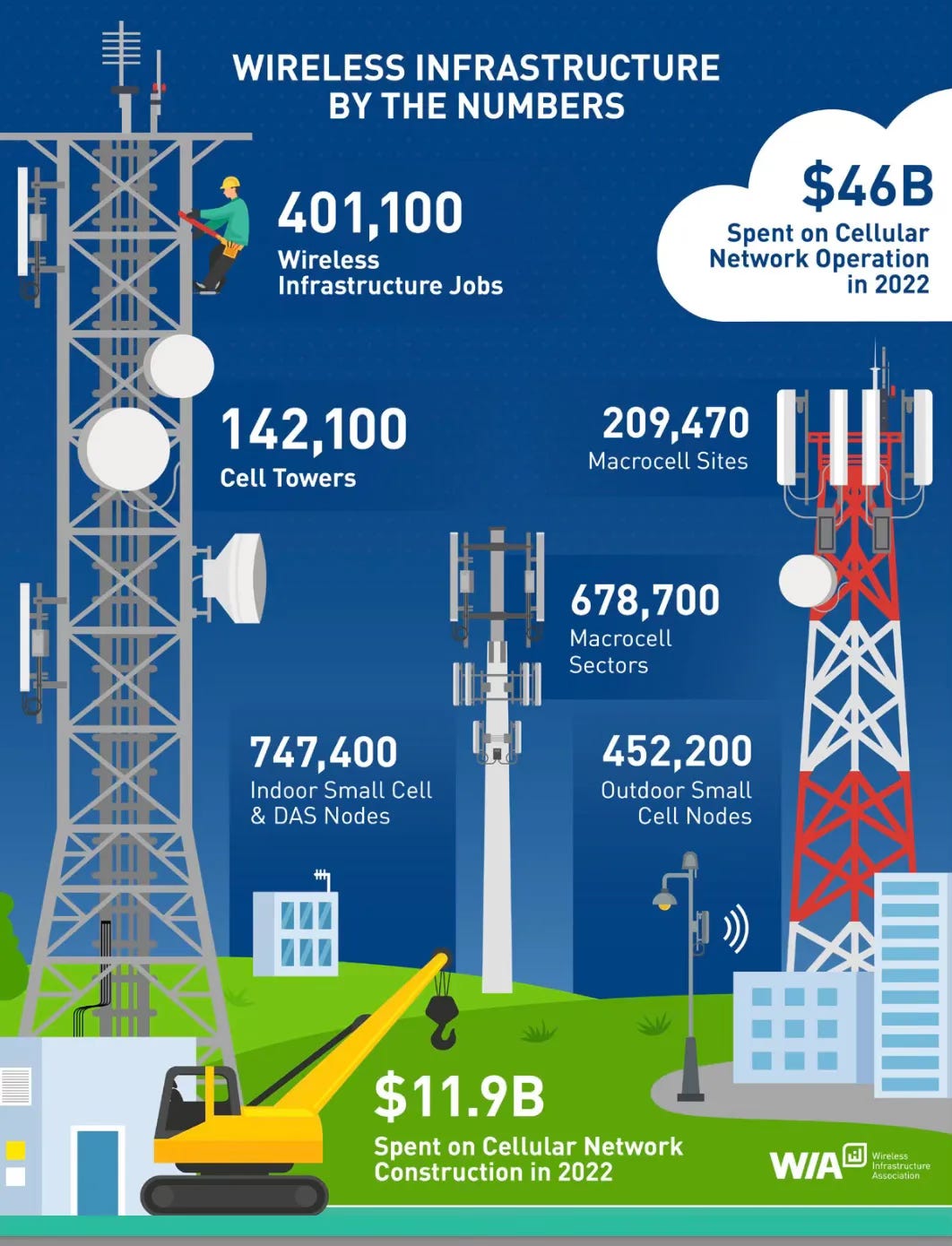

US Wireless Infrastructure Association, 2023

On the impact to society topic, an earlier version of the paper had this chart, based on data provided by GSMA in its annual mobile economy assessment - about $5.7T, of which $1.55T are direct, i.e., through operators, infrastructure, and content and services.

Total economic contribution of the mobile industry, 2023; in USD billions

(Narrator voice: this is how the report ended up being close to 80 pages formatted.)

What China Mobile, Meta and Rakuten and multiple US presidential administrations have in common?

What was most striking in digging into was how operators and policymakers and other stakeholders in very different geographies (say, Meta in the US, which formed the Telecom Infra Project; and China Mobile in China, which formed first the C-RAN Alliance then joined the O-RAN Alliance in 2018; and Rakuten, which saw opportunity to go from MVNO to MNO and roll out Rakuten Mobile and launch service in 2020) assessed the state of RAN supply and supplier-operator relations and all independently came to a similar conclusion:

that the advent of the cloud, and virtualization techniques, should be catalysts to drive efficiencies in RAN design and deployment; help facilitate supplier entry, particularly by players with skills honed in the enterprise IT and cloud market; and potentially lower the deployment costs for mobile networks, ultimately expanding the reach of wireless service.

Specifically, in founding TIP, Facebook (now Meta) looked at Open RAN as a way to lower the cost of mobile service; in founding the C-RAN Alliance, Chinese network operators looked at Open RAN as a way to hedge supplier (e.g. Huawei and ZTE) power; and in founding the X-RAN Forum, global network operators looked at Open RAN as a way to make the RAN software-definable. Similarly, enterprise IT suppliers, such as chip makers (e.g., Intel) or equipment makers (like Dell Technologies) saw a market that would likely share more similarities with the enterprise IT market, as did the hyperscalers (e.g., Amazon Web Services).

I will add multiple US presidential administrations to the list of keenly interested stakeholders (see the Quad meeting agenda listed above), though in

a US national security context, Open RAN has come to mean “not Chinese” and also “a supplier other than Nokia and Ericsson.”

and also

“not in China either,”

Which, of course, harbors risk of reducing the overall market opportunity for new suppliers.

Going forward,

With Open RAN now at 5–10% revenue share in the total RAN market, depending on the quarter, we can say that Open RAN has been moderately impactful. Case studies like Rakuten Mobile have shown what is possible through the adoption of virtualization techniques in deploying networks. Going forward, we view that adoption by incumbent operators, and consistent support by policymakers, will be essential for Open RAN to truly lead to meaningful changes in RAN supplier diversity.

As mentioned I got started in spring 2023.

Much of 2023 and 2024 were spent on interviews. (Writing on Longevity Hubs was largely done by spring 2023.)

I presented an early version of the paper in fall 2023 at a Berkeley APEC Study Center and Berkeley Risk & Security Lab research exchange.

A lot of the writing happened in summer 2024.

Salt Typhoon - reporting of intrusion by Chinese hackers into multiple US telecom networks, and into presidential campaigns - added a timely reminder of the importance of network modernization, both by network operators and law enforcement (which might use old routers absent funding to upgrade).

Salt Typhoon, unfortunately, provided a bit of a rejoinder to a comment made by multiple network operators - that they wanted to see new(er) Open RAN suppliers reach “feature parity” with traditional suppliers. Just how important will legacy support of 2G/3G features be in a 5G/6G era? Particularly if older generations pose security vulnerabilities?

Which gets me to the recommendations (from the executive summary - the full report has more detailed recommendations):

Recommendations to Network Operators:

Some network operators interviewed for this report commented that they want to see Open RAN suppliers reach “feature parity” with traditional suppliers. Network operators should thoughtfully assess just how important support of legacy features from the 2G or 3G era will be in a 5G/6G era. For how long, and for what purpose, would new 5G/6G RAN suppliers be expected to provide 2G/3G-era features? Recent cyber intrusions into US telecom networks — which may have exploited interfaces provided for lawful intercept highlight the urgency to modernize US communications networks. Network operators should be looking forward, and investing in network modernization, rather than forcing new suppliers to invest in support of legacy features.

Operators should re-invest in their network integration capabilities, to enable more robust services and to mitigate dependency on a concentrated set of suppliers. Open RAN enables creative combinations of different RAN suppliers.

Network operators will often issue debt for the purpose of network investments or spectrum purchases. To foster greater liquidity in the smaller network operator market, we recommend exploring establishment of a “Telly Mac” that would facilitate bundling of compliant network operator debt issuances, similar to how Fannie Mae and Freddie Mac help provide liquidity to the mortgage market.

Recommendations to the National Telecommunications and Information Administration (NTIA):

We recommend that the NTIA continue on the path set with its 2023 5G Challenge, and begin planning for a series of 6G challenges, with a focus on open, resilient networks provided by non-traditional suppliers.

We recommend that the NTIA consistently issue SBIR (Small Business Innovation Research) solicitations for Open RAN to help nurture small business and startup suppliers.

We recommend that the Public Supply Chain Wireless Innovation Fund be renewed after it is depleted, as it will take multiple iterations to meaningfully impact the state of RAN supply. Consistency of funding opportunities will help nurture suppliers, and also induce more innovators to direct resources towards solving the technical challenges involved in developing open, resilient networks.

Recommendations to the Federal Communications Commission (FCC):

The FCC should measure the state of RAN and telecom equipment supply as part of its broadband measurement process. Increased clarity on the state of supply would help in understanding dependencies and potential vulnerabilities.

We recommend fully funding the FCC rip-and-replace fund, which is underfunded relative to industry requests by at least $3 billion. Upgrades should be done with the broader goal of network modernization and making networks more open and resilient.

The FCC’s $9B Rural 5G Fund remains unallocated. These funds should be put to work with the service goal of providing better 5G coverage in rural areas, and with the policy goal of enabling more modern, open and resilient networks, not just in urban areas, but also rural areas.

We also recommend that the FCC seek to better coordinate its funding opportunities with NTIA.

In addition,

we recommend that the US government, potentially together with allied governments, contemplate an “Operation Warp Speed” for wireless, i.e., a focused effort to drive rapid innovation (in the US case, for 6G) similar to the effort that led to the accelerated development of the COVID vaccine. If governments truly want open, resilient wireless networks for 5G or 6G, more concentrated guidance and support could help deliver this outcome. Further, allied nations, such as members of the Quad (Australia, India, Japan, and the United States), could pool their resources to provide further scale for such an initiative.

The report has other recommendations, including strategic venturing, a la In-Q-Tel or DIU, and how to better nurture chip suppliers for RAN networks.

Some context about what would be impactful in terms of impacting RAN supply, or inducing supplier activity:

The global RAN market is about $40 billion per year, within a $100B telecom equipment market.

$11-$12B are spent on network construction in in the US each year, and about 1/3 of network operator capex goes towards supplier equipment (e.g. RAN equipment.) So if T-Mobile spends $15B/year, maybe $5B will go towards supplier hardware.

Both the Trump Administration (Trump I) and Biden Administration set aside funding for rural broadband.

The FCC’s $9 billion Rural 5G Fund was created in 2019;

the Infrastructure Act of 2021 set aside $42.5B for the BEAD program. (States then were tasked to develop plans on how to spend that funds, and that work was finally complete in December 2024.)

As of the end of 2024, both of those were completely unspent.

That combined sum is more than enough to stand up a new national greenfield operator, with funds to spare. Not that we are advocating this - we aren’t - but rather, the point is to say, the funds multiple US administrations have set aside - and not spent - are enough to move the needle, if thoughtfully applied.

Looking forward to your comments!

Jon

Thank you for this Jon and congratulations on the report. I'll definitely find some time over the next week or so to read in full.