Return appearance on The Circuit podcast

plus, an article for War on the Rocks on the Double Power Law of US innovation

Friends,

It was nice to hear from some of you after my last post. What’s that, you missed it? Not to worry - Here it is.

A warm welcome to new subscribers! And a welcome back

Looking for something fun to do in the Bay Area? I encourage you to join the 15th Annual Japan-US Innovation Awards, happening Thursday July 17 at Stanford University. The event is co-produced by the Japan Society of Northern California (where I’m on the board) and Stanford University’s US-Asia Technology Management Center. (Haas students, DM me on the Haas Slack if you’re interested in attending.)

Here’s the agenda. And here are video highlights from last year’s event.

On to our newsletter!

Speaking of Japan’s semiconductor revitalization, I made a return appearance on The Circuit podcast (Episode 124) to discuss Japan’s semiconductor industry.

👉👉 Here’s the episode: Apple | Spotify.

Thanks again to

for having me back. This was my first appearance since December 2023 (Episode 45: Apple | Spotify). 79 episodes later, it was good to be back.Jay and I discuss:

The purpose of taking a clustering perspective when looking at areas targeted by government support, e.g. Kumamoto or Sapporo/Chitose - this helps get a view of regional civic, administrative and academic capacity (or constraints)

Rapidus’ proposed positioning: I characterize it as the “Flex of logic” (as in the old Flextronics; with all that implies about being customer-centric and managing lots of customers)

measures of success to look for with Rapidus - I put forward two:

(1) can they lower the cost barrier to custom silicon by being able to take on smaller orders (and thus induce more companies to roll their own); and

(2) do the firms that help hyperscalers with their silicon initiatives start working with Rapidus

Why Kumamoto was a very logical location for TSMC to choose

How what the Japanese government is doing in licensing technology for the Rapidus initiative is like Tiger Technology in reverse (imagine Howard Lutnick or Gina Raimondo suiting up to license technology from IMEC or IBM and you get the idea)

A potential “missing middle” in the talent pool in Japan for semis?

Differences in how universities (specifically, UC Berkeley versus universities in Japan) teach students on semiconductors - UC-Berkeley largely assumes students will go work for fabless firms (e.g. Apple or NVIDIA), Japanese universities (particularly Kumamoto University) teach generally assuming students will work for TEL or Sony Semiconductor or TSMC

Companies of note, in addition to TSMC and Rapidus, including: Resonac (the former Showa Denko and Hitachi Chemical); Tokyo Ohka Kogyo; Shin’Etsu; Tokyo Electron; Sony Semiconductor; Renesas; Kajima (builder of the first TSMC JASM fab and in-progress Rapidus IIM fab; Denso; Sakana; EdgeCortix; Fujitsu (in supercomputing); Kioxia and Micron (acquirer of Elpida Memory assets and investing in HBM capacity in Hiroshima)

Kajima got a nice shout-out here hat-tip

What I want to do next:

Visit the Tsukuba robotics cluster

Visit Tohoku

Speak to more firms on the demand side (consumers of silicon) - chips are produced to go into supply chains, so this means speaking to firms in automotive, robotics and AI

Two discoveries so far:

Increased interest in dual-use technology and movement toward technology-security ecosystem inspired by that in the US (think DIU or In-Q-Tel) and the UK

Keen, keen local interest in silicon photonics, as proposed by NTT as IOWN (光電融合 or photonics electronics convergence)and also, separately, by TSMC (and here I will note Broadcom had some presence at the NTT Upgrade event in San Francisco in spring 2025)

Again, the episode can be found here 👉👉: Apple | Spotify.

Thanks again to

for having me. (Hopefully Ben will join next time!)Looking forward to your feedback! Curious about semiconductors in Japan? Want to talk about Rapidus, or silicon photonics? I’d love to hear from you.

Next step, my faculty colleague Andrew Reddie and I teamed up on a contributed article for War on the Rocks - The Double Power Law: How American Innovation Really Works.

Andrew is assistant professor in the Goldman School for Public Policy (GSPP) and also faculty director and founder of the Berkeley Risk and Security Lab, where I am both faculty fellow and advisory board member.

This all came out of a coffee conversation. Good things happen when the caffeine starts flowing. ☕☕💡🖋️

To frame the article a bit - the Power Law is a “known known” and frequent descriptor Silicon Valley venture economics:

Venture capital fund returns are characterized by a power law distribution (at the fund level - a few investments return the whole fund and provide returns to LPs)

Venture capital industry returns are also characterized by a power law distribution - returns are concentrated in a few top-performing funds

It’s a phenomenon that also plays out in venture-backed markets - winners enjoy the flywheel of success, non-winners get acqui-hired or exit (think Zoom, versus, say, BlueJeans)

The phenomenon even provides the title for Sebastian Mallaby’s excellent 2022 book: The Power Law: Venture Capital and the Making of the New Future, which I use in Opportunity Recognition class.

What’s less known is that the same power law phenomenon plays out upstream of the venture economy - namely, in the American research innovation ecosystem. Broadly distributed, relatively small-dollar grants fund research exploration….which de-risks technology seeds later amplified by the downstream venture economy. Some research seeds never cross the valley of death; others beget CRISPR or mRNA. Or the Mosaic browser. (Without federal funding to the University of Illinois, does Mosaic happen?)

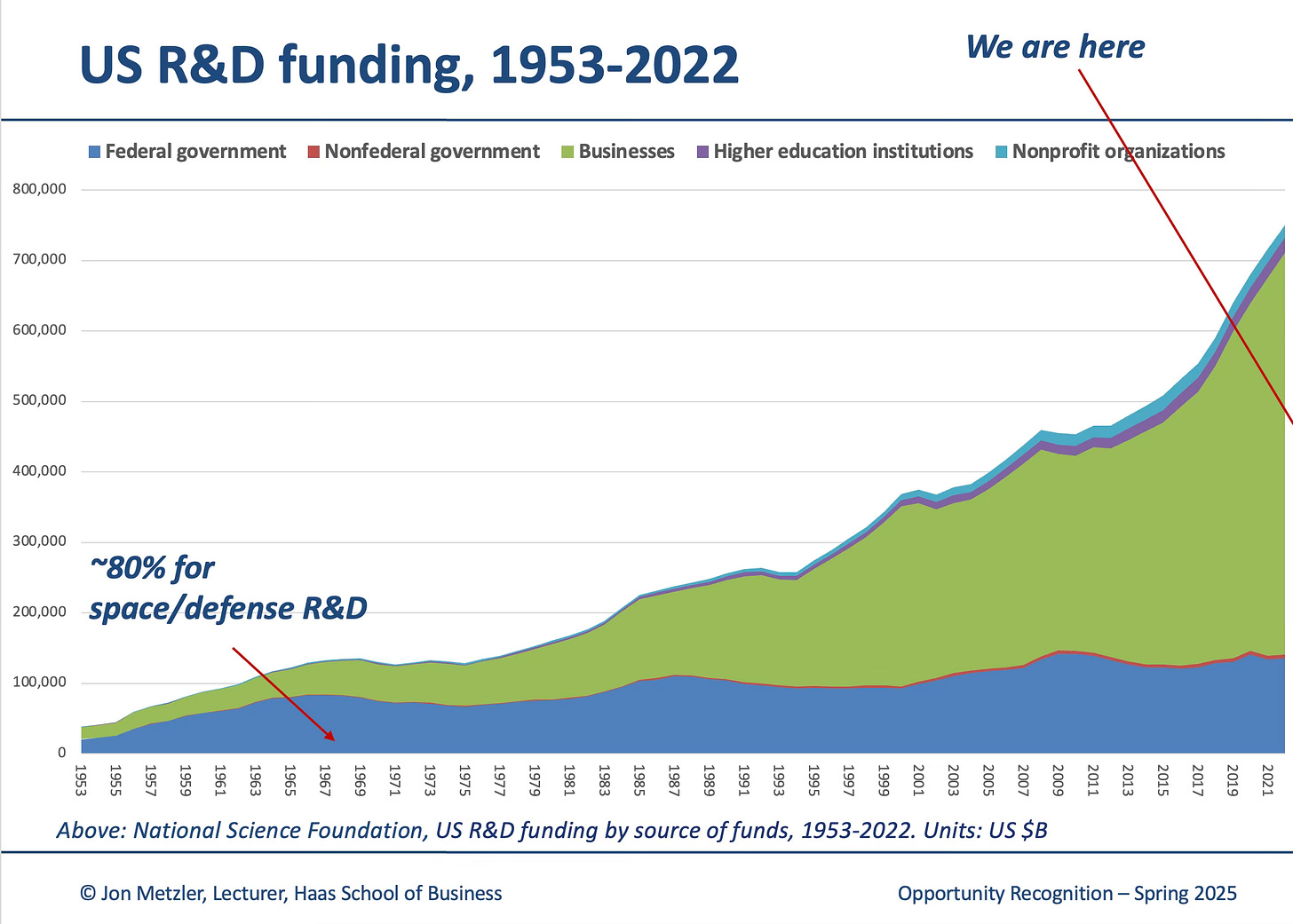

How much does the US spend on research? As of 2022, the United States spent an estimated $885.6 billion on research and development, of which $159.8 billion was funded by the federal government. Federal funding, in particular, funds this basic exploration, whereas corporate research generally is more applied.

Students from Opportunity Recognition (and some sections of Strategy for the Networked Economy) will recognize this chart.

So, yes - cutting and culling upstream research in the name of efficiency will likely have harmful impacts downstream, on the venture economy. Or, as Andrew and I put it:

This research innovation ecosystem is an essential enabler of the downstream venture capital ecosystem that has transformed the U.S. economy. Like the venture economy, the research innovation ecosystem is characterized by a power law distribution of returns. Some research strands yield today’s mRNA or CRISPR. Others never traverse the valley of death — the stage where commercial interest is too uncertain and technical risk too high to attract private investment. The very heterogeneity of the portfolio is the point. The successes in the short tail emerge because of the breadth of exploration that has characterized the U.S. innovation ecosystem for 80 years.

There are two valleys of death: one technological and one commercial. The research ecosystem addresses the former; the venture capital ecosystem focuses on the latter. The research ecosystem de-risks technological seeds; meanwhile, venture capitalists invest in teams, technologies, and markets. And venture capital itself thrives on a power law: a few big fund-returning winners make up for a long tail of middling or failed investments. The genius of the U.S. innovation ecosystem is that it tolerates this uncertainty, understanding that asymmetric returns are a feature, not a bug.

Andrew and I close by recommending:

To compete with geopolitical challengers like China, the United States should double down on the very model that built its technological and human capital advantage: decentralized funding, open inquiry, and public-private complementarity.

Defunding the research innovation ecosystem in the name of efficiency is penny-wise and pound-foolish. Further, it will shrink the pool of technology available to be brought to market by the downstream venture economy. Would venture capitalists move upstream, to fill in gaps in the research funding ecosystem? Not likely — they have very different incentives, driven by the need to deliver consistent returns to limited partners. They are not in the business of funding research.

The article in its entirety is here.

Looking forward to your feedback. It was a pleasure to team up with Andrew on this.

Onward and upward,

Jon

This Joni Mitchell tune - and Janet Jackson’s later adaptation - seem on point for this edition!