Why look at Open RAN

A confluence of factors, from 6G (!) to the Quad to Rakuten Mobile

Friends - in my last note I ended by mentioning an upcoming paper on Open RAN. This post is one in a sequence on the topic. I will start with the basic question: why look at Open RAN? From late 2022 through spring 2023, there was a confluence of events that got my attention.

Verizon, in its 2022q2 earnings (July 2022), shared that 47% of postpaid subscribers had 5G phones. As of September 2023, that share was 68%. With the bulk of subscribers on 5G, when would Verizon and other network operators in advanced wireless markets start looking ahead to 6G?

In May 2023, in advance of a meeting of the nations of the Quad (Quadrilateral Security Dialogue, composed of Australia, India, Japan, and the United States), NTIA released the Quad Open RAN Security Report, a work product of the Quad Critical and Emerging Technology Working Group. This work was set in motion by a signing of an MOU by the members of the Quad in May 2022.

Japan’s Rakuten continued a sequence of transactions (e.g. floating shares in Rakuten Bank) with the goal of producing cash to offset investment into rollout of Rakuten Mobile, a rare greenfield mobile network that harnesses Open RAN techniques. And while Rakuten Mobile has yet to get to standalone operating profitability (and has increased Rakuten’s debt load), it is simultaneously true that Rakuten Mobile has gotten to market in a capital-efficient way relative to traditional network operators, by harnessing Open RAN techniques.

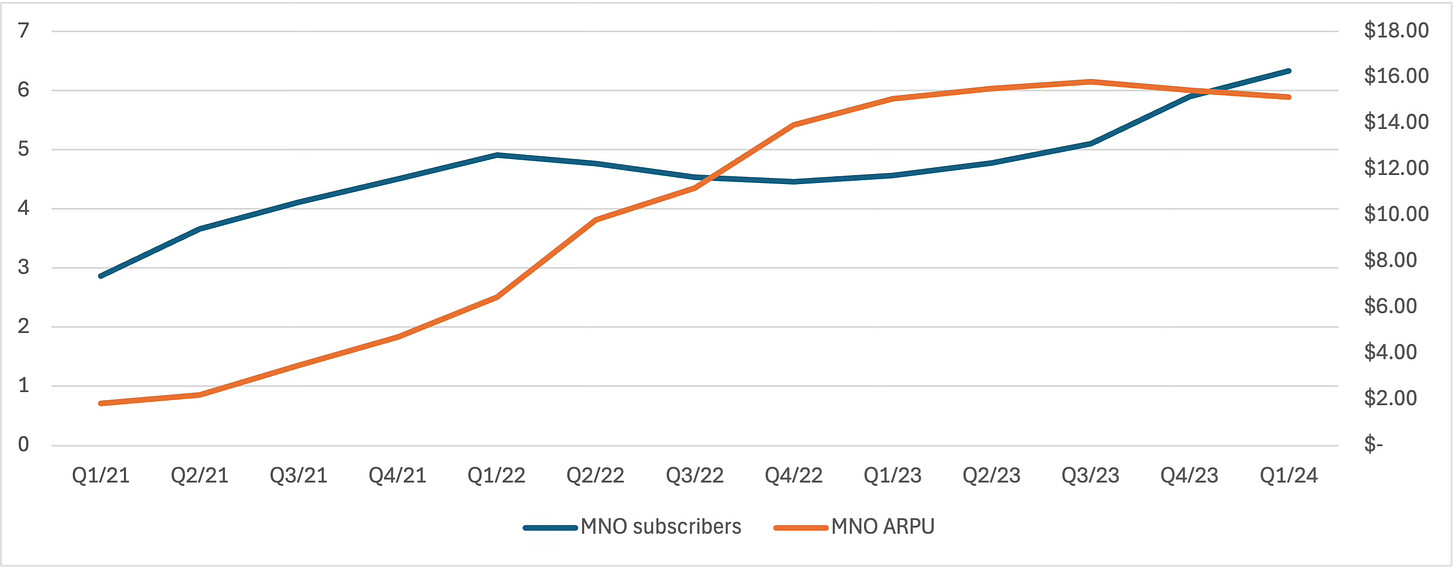

Rakuten Mobile ARPU and subscribers, 2021q1-2024q1. Source: Rakuten IR. Left Y-axis: subscribers; right Y-axis: monthly ARPU, converted at $1 USD = JPY 130.

These among other factors - a significant fourth one being communications infrastructure (if not broadband subsidies) is a generally a topic of bipartisan agreement in the US - made the timing right to dig into the topic of Open RAN!

With support from the UC-Berkeley Center for Long-Term Cybersecurity, I got to work in spring 2023 assessing Open RAN, specifically with the goal of answering these three questions:

What is the significance of Open RAN for network operators who are making 5G supplier decisions, or who are beginning planning for 6G?

What is the current state of supply in the RAN? What actions can policymakers take to facilitate supplier diversity in the RAN? What would be the consequences of lack of action, or sporadic action?

At a higher level, what is the significance and benefit of innovation in the RAN?

And indeed, governments are starting to looking ahead to 6G: in February 2024, NTIA, on behalf of the United States, issued a joint statement with the governments of Australia, Canada, the Czech Republic, Finland, France, Japan, the Republic of Korea, Sweden, and the United Kingdom on Principles for 6G: secure, open and resilient by design.

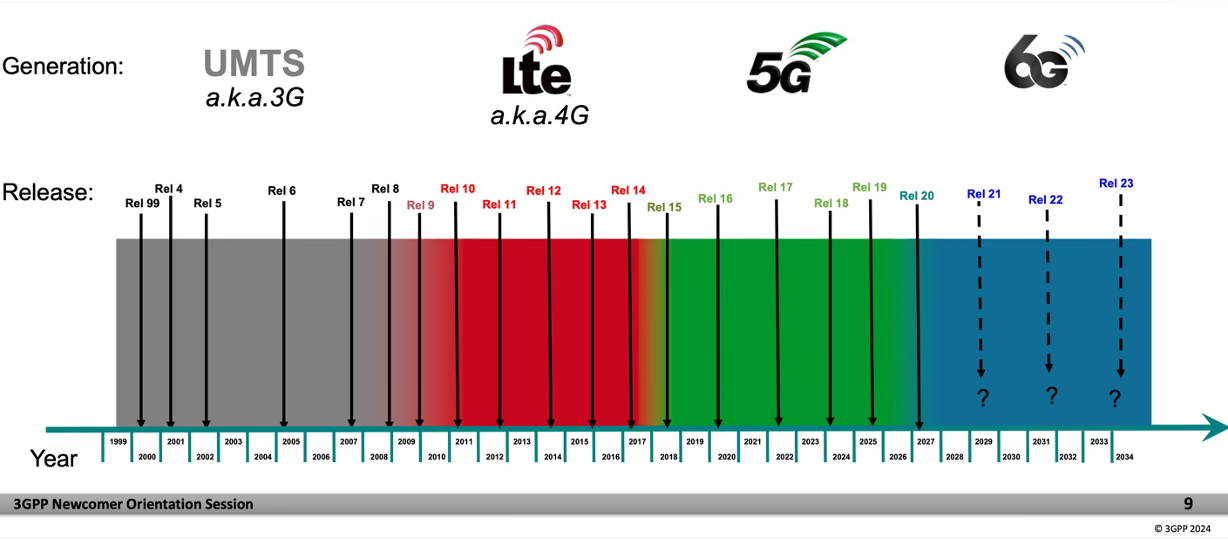

Standards bodies are looking ahead to 6G as well: 3GPP estimates its first 6G release will be in 2027. Pre-standardization study has already begun.

So, if greenfield entrants are harnessing it, and policymakers are talking about making networks open and resilient - what exactly is Open RAN?

Radio Access Network (RAN) equipment refers to equipment in a wireless telecommunications system that provides the wireless access link with the customer handset (e.g. smartphones; sometimes known as UE or user equipment), and also manages radio resources. Below, cell sites seen in the wild - in this case, a Berkeley restaurant patio.

Open RAN refers to a movement to unbundle the RAN, i.e., disaggregate what historically had been monolithically provided by one supplier (e.g. Ericsson); to facilitate greater interoperability between supplier hardware and software.

This began with 4G, which split the base transceiver station (BTS) into two elements: the Remote Radio Head (RRH) and Baseband Unit (BBU). A motivated integrator or operator could integrate RRH and baseband products from different suppliers (and indeed this is what Rakuten Mobile did with its 4G rollout, pairing Nokia and Altiostar equipment).

With 5G, this disaggregation has continued, dividing the RAN into three products: Radio Unit (RU), Distributed Unit (DU), and Control Unit (CU), shown in the diagram from Nokia Networks below.

Nokia Networks, Open RAN explained, 2020

Within the broader topic of Open RAN, there are multiple terms used:

Open RAN: as a general term refers to unbundling the RAN into Radio Unit (RU), Distributed Unit (DU), and Control Unit (CU) products. In a technical sense, it means standardizing and publishing the interfaces between these products.

Cloud RAN: refers to putting elements of the RAN, such as the CU, in the cloud.

Virtualized RAN, or vRAN: refers to virtualization of either DU or CU (vDU or vCU) products. Virtualized RAN products were about 2.5% of the total RAN market in 2022.

Nomenclature thus established, it was clear in spring 2023 is that this was a topic of global attention. Reporting indicates President Biden has raised the topic of Open RAN in meetings with heads of state, and not just fellow Quad members, but also Saudi Arabia, Brazil, Palau, Indonesia, and the Philippines, among others (WaPo gift link; wondering if POTUS donned his aviators when in telco infrastructure pitch mode).

Next, I’ll try to set a little mobile industry context.

Why innovation in the RAN matters - the mobile industry today

Over 50 years have passed since Motorola executive Martin Cooper placed the first mobile call on the streets of Manhattan in 1973, using a handheld, battery-powered Motorola DynaTac. The origins of mobile telephone date back further, to 1946, when AT&T first demonstrated a mobile telephony service targeting in-car users. Thus, it was symbolic that the call Cooper placed in April 1973 was to Joel Engel, then head of research at AT&T Bell Labs.

Since then, the mobile industry has blossomed worldwide. As of the end of 2023, GSMA, the global mobile network operators association, estimated there were 5.6 billion unique mobile subscribers in the world using 8.6 billion SIM connections, with additional 3.5 billion connected devices (IoT connections) supported by cellular lines. GSMA further estimates that mobile technologies and services contributed 5.4% of global GDP, or $5.7 trillion, of which $1.55 trillion came directly through the mobile ecosystem of network operators, infrastructure and equipment, and content and services.

The rate of global subscriber growth has slowed in recent years, but total subscriber lines still increase by 150 to 200 million annually. GSMA estimates 111 mobile subscriptions per 100 people worldwide as of 2023. Looking ahead, GSMA estimates there will be 6.3 billion unique mobile subscribers by 2030, or about 73% of a projected global population of 8.6 billion.

Both handsets and mobile infrastructure require access to power, and thus our ability to connect the remaining more than two billion potential subscribers is influenced not just by service availability and affordability, but also the availability of power sources for networks and handsets.

Global mobile subscribers, 1993-2022. ITU data, February 2023. Units: millions

Network technology roadmap

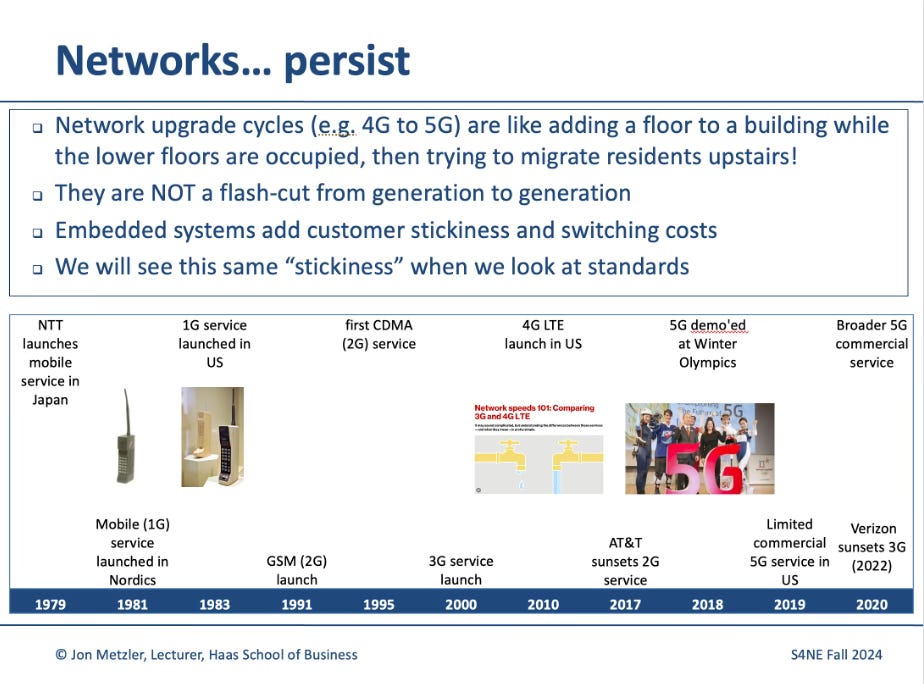

GSMA predicts that 56% of global connections in 2030 will be 5G connections, and that 90% of subscriber lines in North America will be 5G. Network operators generally upgrade network technologies (generations, e.g.. 1G, 2G, 3G, etc) on a once-per-decade cadence, with incremental mid-generation upgrades (e.g. 2.75G, 3.5G) occurring in between. Generations and representative services are introduced below.

1G: the Motorola DynaTac used by Marty Cooper to call AT&T in 1973 was later sold as a 1G (first generation) phone in the 1980s. 1G supported analog voice service. There were multiple 1G systems, such as AMPS in the United States, NMT in parts of Europe, and TACS in the United Kingdom. 1G voice systems were unencrypted.

2G: In 1991, GSM service was first launched in Finland. 2G added encryption to calling. In addition to voice, 2G phones supported texting and later lightweight data services. There were multiple 2G standards: GSM in Europe; TDMA and CDMA in the United States; and PDC in Japan. The first iPhone, launched in 2007, was a 2.75G or EDGE phone.

3G: NTT DoCoMo launched 3G service in Japan in 2001. 3G enabled mobile web services and also early smartphones, such RIM’s BlackBerry. The second iPhone, launched in 2008, was the first 3G iPhone. Mid-generation 3G enhancements, such as HSPA (3.5G), enabled more robust data services.

4G: TeliaSonera launched the first 4G service in Norway in 2009. Verizon launched 4G in the United States in 2010. 4G networks, combined with the advent of mobile OS platforms and current-generation smartphones, enabled today’s mobile app economy.

5G: KT launched service in Korea timed with the 2018 Winter Olympics. In the US, initial 5G service began in 2019. 5G networks lowered latency or network response time, enabling a more diverse set of applications, such as enterprise and industrial applications.

I introduced some of these milestones in Strategy for the Networked Economy class earlier this fall.

Looking ahead:

6G: by 2030, it is likely that operators in advanced wireless markets will have launched 6G service. A variety of governments, including China, Finland, India, Japan, South Korea and the United States, have issued announcements indicating intent to take leadership roles in 6G standards development and network deployments.

In subsequent posts, I will take a look at:

the state of competition in the RAN market (TL;DR: it’s still concentrated!)

are there new RAN suppliers (outside of the usual suspects of Nokia, Ericsson, Huawei, Samsung and ZTE)?

How long does it take for wireless infrastructure startups to mature?

Looking forward to your questions and comments.

Happy Halloween!

Jon