Cyber and antifragility; cyber and M&A

SEC rules to make the collective stronger; plus, NVIDIA and paths not taken

Friends - Very nice to hear from some of you after my last post. Spring has sprung here in the Bay Area. From the upper classrooms in Chou Hall at Haas, San Francisco looms like a beacon. (Is that the sound of AI being made?) Below is the campus view between morning and afternoon section on Monday March 18.

A warm welcome to new subscribers! Some of you are current or recent students; others came viaBabbage🙇♂️ . Thanks for being here! By way of introduction, in this newsletter I generally cover themes related to my instruction:

Strategy for the Networked Economy

Clusters: Locations, Ecosystems and Opportunity

Business in Japan

Competitive Strategy

For those who came in viaThe Chip Letter - some, but not all, posts here will be on semiconductors. Open RAN is another topic I’ll be covering. This piece will NOT be about NVIDIA GTC (AI Woodstock!), though this week’s events were thought-provoking on many levels. More on that below.

Spring B - the second half of spring semester - has begun. I have the pleasure of spending time with half of the first-year full-time MBA (FTMBA) class, two days a week in morning and afternoon sections of Strategy.

We started off Strategy class on a caffeinated, sugary note - with the Cola Wars case (Coke vs Pepsi) on Day 1 (naturally, listed as a “Classic” by HBS publishing, natch); and a Starbucks supply chain case on Day 2. And yes, we had one student who roasts his own coffee - meet the marvelously named Prometheus Coffee (hat-tip Sam Thompson) — which put a lovely twist on our usual discussion of Making vs Buying!

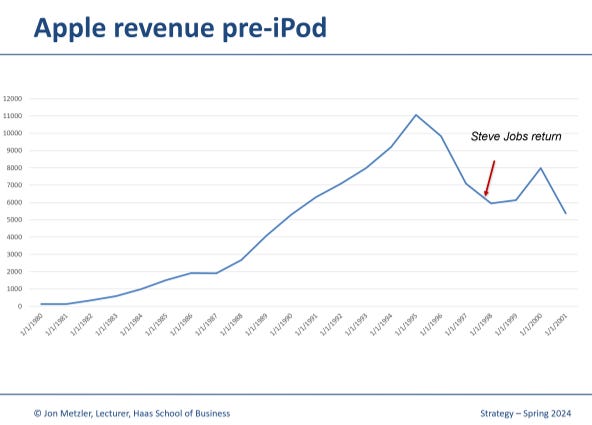

We are now two weeks in - for Class 4 we completed the Apple in 2006 case (a wonderful case on network effects and influencing vital complements, e.g. the music labels). The DoJ dropped its antitrust suit the next day, and it is amazing to think that 27 years ago, Michael Dell was suggesting, as the Apple in 2006 case leads with, that Apple close down and return the money to the shareholders.

This does newly heighten the impact of the great sliding door moments in tech history - Microsoft propping Apple up in 1997. Here’s the 1997 Macworld in which the Microsoft deal was announced. It’s worth watching again, particularly from the perspective of today.

Picking up on the earlier topic of Centrino moments, I did integrate the original Centrino launch into this particular class.

This year’s first-year FTMBA class at Berkeley Haas set records for the highest level of international enrollment and for GMAT scores. Having met some members of class during orientation back in August 2023, it has been delight to finally spend time with them in the classroom.

On to antifragility.

When we returned to in-person instruction in fall 2021, I was looking for a word that went beyond robust or resilient. Both mean something in communications: a resilient network will, for example, survive incident, which is something network operators can design for. A robust communications system can survive interferors. (I heard, and used, the term “robust” in my geolocation days - usually in the context of being robust vis-a-vis jamming efforts or being robust to multipath.) But clearly, robust and resilient also convey meaning in real life.

It was in January 2022 that I found the word: antifragile, a neologism coined by the essayist / author / statistician Nassim Nicholas Taleb, in his book of that name from 2012: Antifragile: Things That Gain from Disorder. Taleb is probably best known for his work Black Swan. With antifragile, he coins a term that describes that which gets better for the stressor.

The paperback version (2014) is pictured below, along with a variety of other class-related influences up in the background for Class 6 (over Zoom) of Strategy for the Networked Economy.

Taleb provides examples from a variety of systems, most notably, entrepreneurs, to show how the failures of one venture can be used to make the overall collective stronger.

As a class, we paired the concept of antifragility with a discussion of the Target hacking case (Cyber Breach at Target; HBS, last revised 2019), and recent SEC regulations requiring that public companies provide an 8-K within 4 days of determining a cyber incident to be material.

The Securities and Exchange Commission adopted final rules requiring disclosure of material cybersecurity incidents on Form 8-K and periodic disclosure of a registrant’s cybersecurity risk management, strategy, and governance in annual reports.

Why the Target case? The lessons and impacts are known and measured and quantified. We can see the earnings impact, and the various costs. So it provides a clear, well-qualified data set.

It also elicited a Senate Commerce Committee report (“A ‘Kill Chain’ Analysis of the 2013 Target Data Breach”), which helps further our understanding of what did, and didn’t, happen, and opportunities to improve.

from Senate Commerce Committee report, March 26, 2014

From the perspective of antifragility, disclosure obligations thus should help with information sharing, and making the universe of publicly traded firms stronger. (There are a variety of dependencies there, of course - both on the disclosure side, and on the learning side.)

As a class, we also discussed opportunities for services firms to be the agents of antifragility - so hopefully companies never have to file a rushed 8-K - not just for public companies, but to private companies as well. As future business leaders, this is something MBAs today should prepare for.

In that same class, we hosted Prakash Krishnan, co-author, along with Prof. Andrew Reddie of the Goldman School, of Moving Left and Right: Cybersecurity Processes and Outcomes in M&A Due Diligence, which was published by the UC-Berkeley Center for Long-Term Cybersecurity in December 2022. Prakash and I connected through the CLTC community and it was a delight to host him in class.

Prakash shared the impetus for his research - Verizon’s acquisition of Yahoo, and the impact of (belated) cyber disclosures. Prakash shared the output of his research, which is a framework that can be applied by both buyers and sellers (and potentially third-parties assisting, such as with diligence) during M&A due diligence. Thanks again to Prakash for joining!

Prakash and Andrew’s report can be downloaded here. Here’s the landing page.

Now, it turns out the concept of antifragility has resonated in a variety of contexts.

Klay Thompson, beloved Warrior whose career was derailed for over three years by injuries, keeps a copy on his bedside table, per ESPN.

In the 2023 version of Strategy for the Networked Economy, I had the delightful surprise of having a PhD student, Caseysimone Ballestas, who had applied the concept of antifragility in creating a taxonomy of ambient intelligent environments for her master’s thesis.

There’s even a K-Pop tune, by the band LE SSERAFIM, called Antifragile (hat-tip to my former student Calvin Alunkal, who brought this to my attention.)

Back to AI Woodstock. More specifically, to NVIDIA and paths not taken.

I have been to NVIDIA GTC before, but didn’t make it this year. (See above teaching schedule.) Still, AI Woodstock was thought-provoking, not just in terms of what happened, but what didn’t.

In September 2020, NVIDIA announced plans to acquire ARM to create a “premier computing company for the age of AI”. In February 2022, NVIDIA and SoftBank, then owner of ARM, called those plans off. SoftBank then floated ARM and ARM is a publicly traded company as of September 2023.

ChatGPT was publicly released in November 2022.

Here, again, we have another sliding door. Watching Jensen Huang, CEO of NVIDIA, offer opinions on what nation-states (e.g. India, Japan) should do with regards to AI, I did wonder what might have happened if NVIDIA had had to put even a portion of resources - a certain percent of a CEO’s time - into the integration of ARM?

I was not alone in thinking about this -

, a staple of this newsletter, put out a newsletter on that topic this week and I recommend it. It’s hard to prove the counterfactual, of course, but as we watch NVIDIA execute on all cylinders, the benefits of paths not taken seem worth noting. It’s also worth noting that ARM, as a public company, has likely benefitted from not being owned by a very busy parent.Back in December 2023, I enjoyed this interview with the CEO of ARM Holdings on the Circuit podcast.

With spring in the air, I’m going to go back to the music well, with a track I featured this time last year: Blossom Dearie’s They Say It’s Spring.

Onward and upward,

Jon