Friends - Welcome to part 3 of an ongoing sequence on Open RAN (Radio Access Networks). Missed the first two? Not to worry, here they are:

Installment 1: why look at Open RAN; the significance of RAN innovation

Why look at Open RAN

Friends - in my last note I ended by mentioning an upcoming paper on Open RAN. This post is one in a sequence on the topic. I will start with the basic question: why look at Open RAN? From late 2022 through spring 2023, there was a confluence of events that got my attention.

Installment 2: network operator-RAN supplier co-specialization

Open RAN (2): mobile network operators and their suppliers

(updated with RAN market concentration data post-publication)

And on to Part 3~

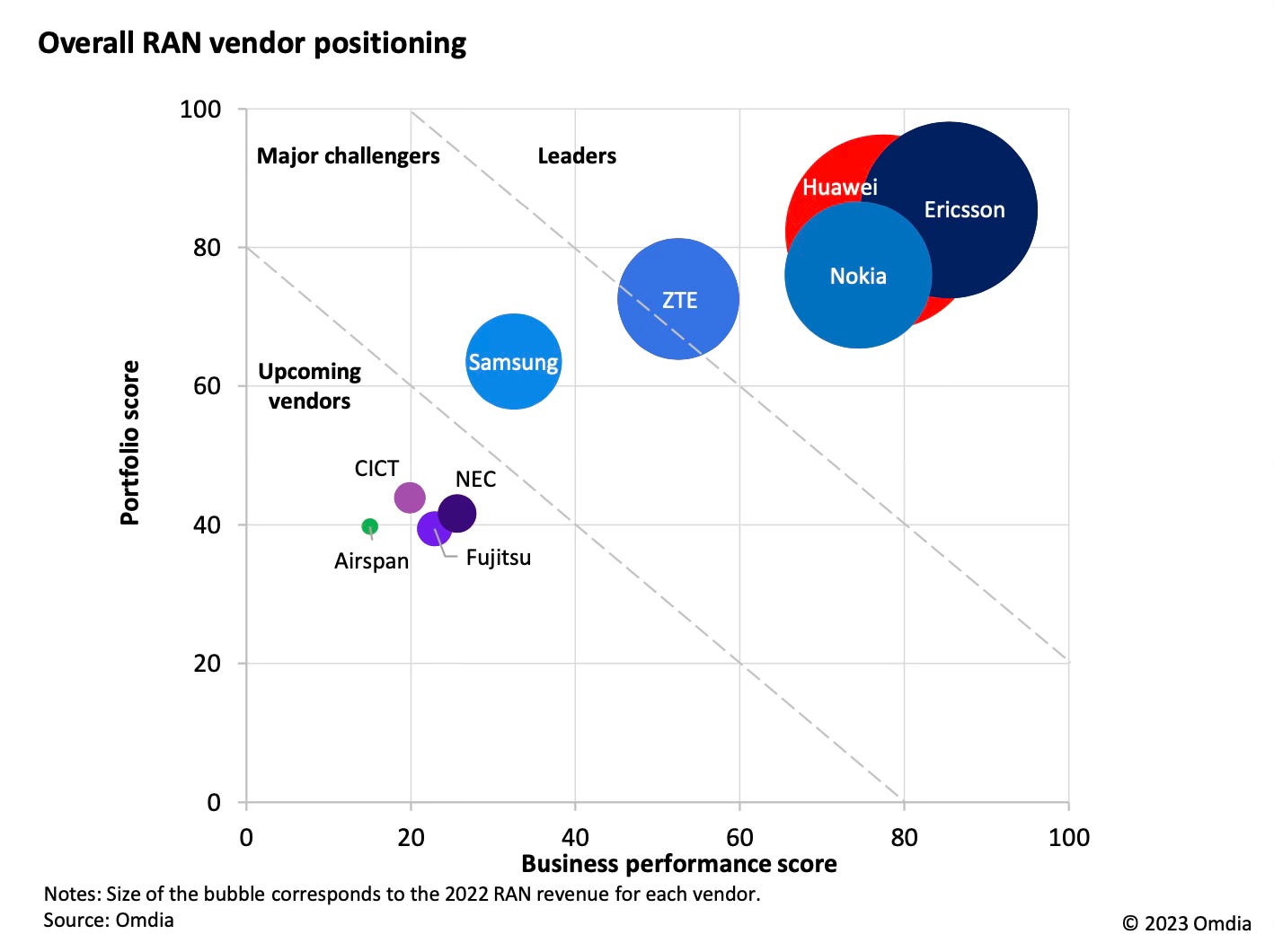

Let’s start with Omdia’s 2023 view of RAN supplier positioning. Y-axis is breadth of portfolio; X-axis is business performance.

Omdia weights business performance by RAN market revenue share; 5G share of RAN revenue; 5G deals with service providers; and “new logos”. Product is weighted by breadth of radio (RU) and baseband (DU, formerly BBH in 4G) portfolio.

Interestingly, longtime suppliers like NEC and Fujitsu are described as “upcoming”, a topic we will return to in a subsequent post. (Suppliers from Japan also have experience with multivendor RAN, which aligns well with network operators interested in creative RAN supplier combinations.)

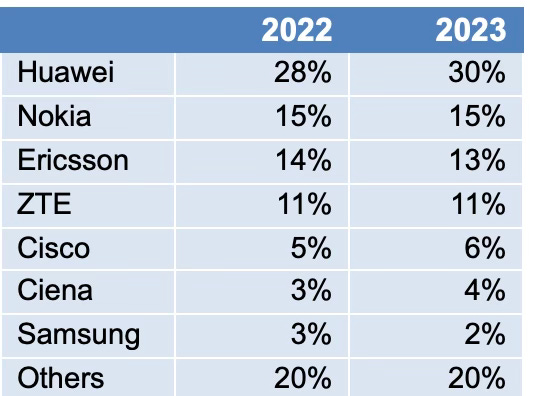

As stated in Part 2, the market is concentrated, as measured by revenue share.

The RAN market is highly concentrated. Dell’Oro estimates that the top five RAN suppliers (Huawei, Ericsson, Nokia, ZTE, Samsung) captured 95.2% of revenue share in 2022, slightly down from 2021 (95.8%); Omdia estimates the top five suppliers captured 94.6% of revenue in 2022. Dell’Oro estimates that the market grew slightly more concentrated in 2023.

The Herfindahl-Hirschman Index (HHI) is a measure of industry concentration. Using Dell’Oro estimates of top five RAN supplier revenue share, we calculate HHI for the RAN supplier market for the years 2021 and 2022 as 2269 and 2229, respectively. The overall HHI score declined slightly year-over-year, due to a slight redistribution of share between the top five RAN suppliers. Still, the RAN market remains concentrated overall. The US Department of Justice, in guidelines updated in January 2024, considers markets with HHI scores in excess of 1800 to be highly concentrated.

As of 2022, Dell’Oro estimated the global telecom equipment market at $100 billion, with the RAN segment at about $41B. In 2023, the global RAN market shrank roughly 10% following a pullback in network operator equipment spending in North America and Europe, both of which are several years into 5G network deployment.,

Revenue share (data by Dell’Oro) in the total telecom market for 2022 and 2023 is provided below. 1

Dell’Oro estimates that US suppliers earned 16% of total revenue in the global telecom equipment market in 2022, particularly in the broadband access, optical transport, and service provider router segments, but had less than 1% revenue share of the global RAN market.

Leading RAN equipment suppliers are Huawei, Ericsson, Nokia, ZTE, and Samsung. Additional RAN suppliers (Upcoming, per Omdia) include NEC, Fujitsu, Mavenir, Rakuten Symphony, CICT Datang Mobile, and Airspan.

There has historically been regionality in company revenue share. This was amplified after the United States placed ZTE and Huawei on trade blacklists in 2018 and 2019, and US allies such as the United Kingdom, Japan, and Australia followed with similar actions. The inaugural Prague 5G Security Conference, held in the Czech Republic in May 20192 and featuring attendees from 32 countries, had a similar catalyzing impact in inducing operators from participating countries to re-assess use of network equipment supplied by Huawei or ZTE in their home market networks.

Major RAN suppliers and their operating segments

While Nokia and Ericsson have spun off their handset divisions, Huawei, Samsung, and ZTE retain handset businesses and are more diversified companies with larger R&D budgets. Samsung, Huawei, and ZTE also have semiconductor business units. Samsung is among the global leaders in semiconductors, not only in market share (e.g., in the memory market), but also in semiconductor fabrication, as measured by process node generations. Samsung has an estimated 11% revenue share in the semiconductor fabrication market, compared to TSMC’s 62%. Samsung had a 45% share in the DRAM memory market as of Q4 2023.

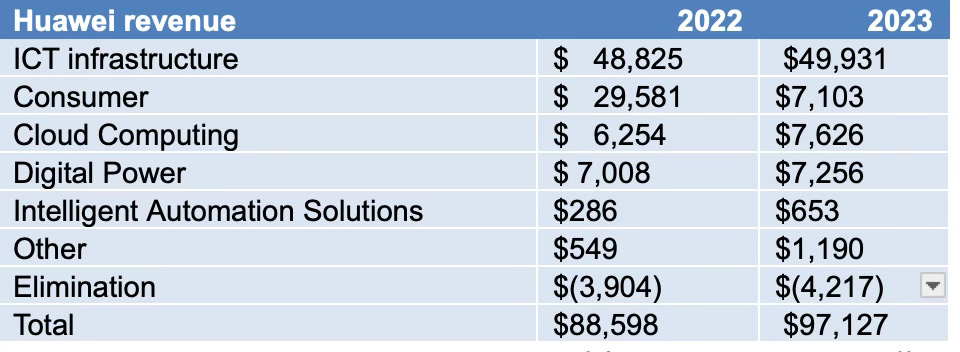

Huawei, Ericsson, Nokia and Samsung Electronics segment revenue is presented below.

Huawei, headquartered in Shenzhen, China, includes RAN products in its ICT infrastructure unit, which includes products for multiple end markets, such as network operators, enterprise, retail, manufacturing, education, and other end markets.

Huawei segment revenue, 2022-2023. Converted from CNY to USD. Source: Huawei 2023 annual report

Ericsson AB, headquartered in Stockholm, Sweden, includes RAN products in its Networks unit, which also includes transport products and IPR licensing revenues.

Ericsson segment revenue 2022-2023, converted from SEK into USD. Source: Ericsson annual reports.

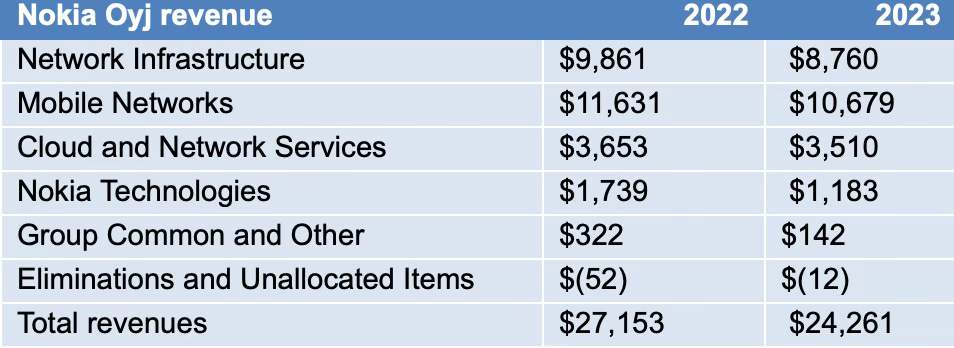

Nokia Oyj, headquartered in Helsinki, Finland, reports revenue from IP routing, optical and fixed networks, and submarine networks in its Network Infrastructure segment., RAN products are reported in its Mobile Networks segment, along with transport network products (e.g., microwave radios). In June 2024, Nokia announced an agreement to sell 80% of its Alcatel Submarine Networks units to the government of France. Nokia had acquired the group with its acquisition of Alcatel-Lucent in 2016. Alcatel and Lucent merged in 2006. (Yes, Nokia, by virtue of acquiring Lucent, is the owner of Bell Labs.)

Nokia segment revenue 2022-2023, converted from Euros into USD. Source: Capital IQ, Nokia annual reports.

Samsung Electronics: Samsung Electronics’ Device Experience (DX) unit includes its Mobile eXperience (MX) / Networks segment and Visual Display (e.g., TVs) product segment. MX / Networks includes both smartphones and infrastructure products such as RAN products. Samsung reports semiconductor industry revenue in its DS (Device Solutions) segment, which includes memory and related products, system LSI revenue, and fabrication revenue. Display products such as OLED screens, both for Samsung handsets and external customers, are reported in Samsung’s SDC (Samsung Display) segment. Samsung acquired Harman in 2016 and continues to report it as a separate segment.

Samsung Electronics 2022-2023 segment revenue. Source: Capital IQ, annual reports. Converted from KRW to USD.

Major RAN providers and their silicon capabilities

RAN equipment uses two key kinds of chips: products for digital networking, and analog products such as RF (radio frequency) transceivers and RF filters and converters. Key providers of analog chip products include Analog Devices and Texas Instruments. Key providers of networking products include Qualcomm and Marvell. (Hat-tip to

here - Jay graciously spent some time with me on this topic.)Huawei retains its own semiconductor design unit, HiSilicon, and both report and investor relations data indicate it is investing in internalizing its own chip fabrication capabilities3, in addition to partnering with Shanghai-based fabrication specialist SMIC.

Samsung Electronics provides both logic and memory products to internal and external customers and also operates a semiconductor fabrication business that makes chips on behalf of external customers.

While both companies have long since exited the handset business, Nokia and Ericsson both retain silicon design capabilities for their RAN products. Ericsson designs its own custom-made chips for traditional RAN products. It partners with Intel for processors for its cloud RAN products, and for manufacture of SoC (system-on-chip) products for traditional RAN products.4 Nokia partners with Marvell for custom chips for its 5G RAN products.

Key network equipment supplier R&D expenditures

R&D expenditures from 2010-2022 by Nokia, Ericsson, Huawei, Samsung and Qualcomm are shown in Figure 12. (As of July 2024, 2022 was the most recent year for which data was available for Huawei, which is privately held; the other four companies are publicly traded.) The drop in Nokia’s R&D in 2011 corresponds with the sale of its handset segment to Microsoft. The increase in Nokia R&D expenditures in 2016 corresponds with the acquisition of Alcatel-Lucent.

The difference in absolute dollars is striking.

Nokia and Ericsson are hardly skimping on R&D investment. Nokia spent roughly 18% of revenue on R&D in 2022, and Ericsson invested 17.4% of 2022 revenue into R&D. Apple, by comparison, spent 8% of revenue on R&D (TTM), and Samsung spent 11% in 2023. Still, the difference in absolute expenditures is substantial - Huawei spent over $22 billion in R&D in 2022, whereas Nokia spent a little under $5 billion in R&D.

Let’s go back in time a bit. As of 2010, Nokia and Huawei’s R&D expenditures were roughly equivalent. As of today, the individual R&D budgets of Huawei and Samsung are greater than those of Nokia and Ericsson combined.

This is not an apples-to-apples comparison, to be fair: Samsung and Huawei both retain handset businesses; Samsung is a leading semiconductor provider and fabricator. Huawei is a more diversified company and is investing heavily in vertical integration after being put in a trade blacklist in 2019 and since US Department of Commerce Bureau of Industry and Security sanctions limiting access to key technologies began in 2022. Huawei states it spent 23% of revenue on R&D in 2023. But Huawei’s increased R&D expenditures show the benefits of a flywheel – more market share enables more revenue enabling more R&D expenditures – and highlights how global mobile operators, particularly those in countries that have removed Huawei and ZTE from their pool of eligible suppliers, are very dependent on the ability of Ericsson and Nokia to continue to innovate. As mentioned in Part 2 of this sequence, all three major US carriers source from Ericsson, for example.

If all of this feels like set-up for Open RAN - it absolutely is!

And we will get into how very different stakeholders (from Chinese network operators to Meta) with different interests all looked at network operator - RAN supplier co-specialization and came to the same conclusion - that unbundling the RAN could help diversify supply and in the process hopefully lower the floor on service costs.

And (hat-tip Stefan Pongratz at Dell’Oro for reminding me) in fairness, the established RAN suppliers themselves - Ericsson, Nokia, and Samsung, for example - are themselves suppliers of Open RAN or unbundled RAN products. As we shall see in further posts and the upcoming CLTC report!

Since we are talking unbundling the RAN - here’s an on-theme tune from Sir Paul’s second act.

Onward and upward,

Jon

https://www.delloro.com/worldwide-telecom-equipment-market-slumps-in-2023/

https://vlada.gov.cz/en/media-centrum/aktualne/prague-5g-security-conference-173333/

https://asia.nikkei.com/Business/Tech/Semiconductors/Huawei-building-vast-chip-equipment-R-D-center-in-Shanghai

https://www.lightreading.com/semiconductors/ericsson-s-cloud-ran-affair-with-intel-is-a-puzzle